For all the worrying about the taper it seems as though the data has continued to hold in there pretty well. We got a few more big data points on the economy this morning and they point to pretty much the same old situation we’ve seen all year – okay, but certainly not bad. Here’s a brief rundown:

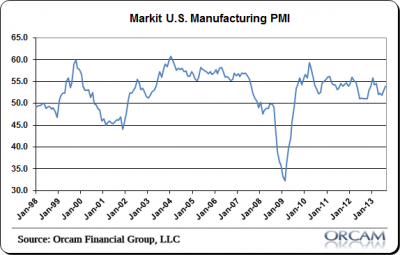

The Markit Flash PMI came in at 53.9 which was up from 53.2 in July. This was a 5 month high, new orders were up strongly to 56.5 from 55.5 and employment was up modestly to 53.2 from 53. Overall a pretty good reading on the US economy.

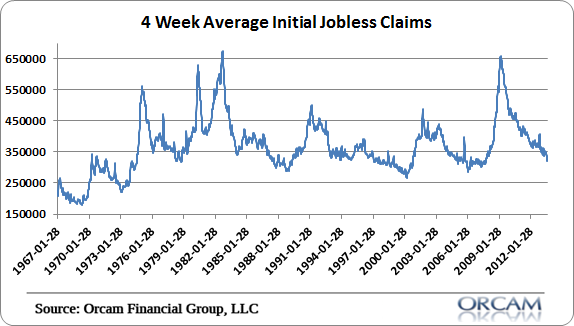

Jobless claims, perhaps the single best real-time reading on the economy, came in low again (which is good). Claims were actually up versus last week (336K vs 323K), but the trend remains solidly downward. I prefer to use the 4 week moving average which will show another solid monthly decline given the latest readings in August.

All in all, it’s not amazing data, but it certainly isn’t worth getting worried about. What’s more interesting is all the fear about the taper talk. If expectations of a taper were impacting the economy then it doesn’t really appear to be showing up in the data….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.