This morning provided a pretty broad overview of the economic situation. And although the news wasn’t particularly great, the market is trading up.

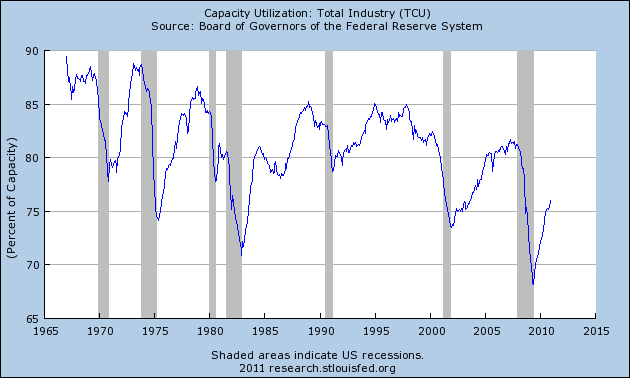

- Industrial production and capacity utilization surprised on the downside. Industrial production declined vs last month while capacity utilization came in at 76.1%. Both were shy of analyst estimates who were looking for a 0.5% gain in production and 76.5% on capacity utilization. The Fed provided some details:

“Industrial production decreased 0.1 percent in January 2011 after having risen 1.2 percent in December. In the manufacturing sector, output increased 0.3 percent in January after an upwardly revised gain of 0.9 percent in December. Excluding motor vehicles and parts, factory production rose 0.1 percent in January. The output of utilities fell 1.6 percent in January, as temperatures moved closer to normal after unseasonably cold weather boosted the demand for heating in December; the output of utilities advanced 4.1 percent in that month. In January, the output of mines declined 0.7 percent. At 95.1 percent of its 2007 average, total industrial production in January was 5.2 percent above its level of a year earlier. The capacity utilization rate for total industry edged down to 76.1 percent, a rate 4.4 percentage points below its average from 1972 to 2010.”

- Housing starts were stronger than expected although permits declined. Econoday provides the details:

“Housing construction was mixed in January and remained at a very soft level. Starts advanced while permits fell back. Housing starts in January jumped 14.6 percent after slipping 5.1 percent the month before. The January annualized pace of 0.596 million units beat analysts’ forecast for 0.540 million units and is down 2.6 percent on a year-ago basis. January’s pace is the highest since 0.601 million seen in September 2010. The latest gain was led by a monthly 77.7 percent surge in multifamily starts, following a 10.8 percent rise the month before. The single-family component slipped 1.0 percent after declining 8.4 percent in December.”

- New mortgage applications declined 7.9% vs last week according to the Mortgage Bankers Association. The large decline was due to rising mortgage rates. Apparently, Bernanke’s goal of keeping rates low and generating easier credit conditions is failing to boost the consumer’s largest asset. The MBA details the decline:

“Mortgage rates remained above 5 percent last week, up almost a full percentage point from their October lows, and refinance volume continued to drop,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Applications for home purchases also declined on a seasonally adjusted basis. Buyers have not returned to the market as rising rates have reduced affordability, to some extent.”

The four week moving average for the seasonally adjusted Market Index is down 4.5 percent. The four week moving average is down 1.9 percent for the seasonally adjusted Purchase Index, while this average is down 6.2 percent for the Refinance Index.”

- PPI came in hotter than expected. Headline was 0.8% while core came in at 0.5%. Analysts had been looking for 0.8% and 0.2%. The recent surge in food and gasoline costs are beginning to have a broad impact. The primary cause of the rise in core was due to pharmaceutical preparations. All in all, this points to margin compression and continuing signs of robust growth abroad. For Americans, this is not a welcome development. For US corporations it is more mixed as there are signs of being able to pass along some costs.

- Although stocks initially traded lower on the news the overnight market provided higher ground from which to fall. Stocks are now ripping higher after stabilizing. It was an odd session overnight in the futures markets – as many have been lately. A fairly sizable buyer entered the market on 6 different occasions in what appeared like blatant attempts to jam the indices higher. This trader was not looking for price – which is generally not a problem in the thinly traded overnight sessions – the market tends not to “run away” from you. But this trader was entering sizable market moving trades in one block stints that were moving the indices 0.1% at a time. It could be due to any number of things, but it’s most likely just one more sign of the complacency that is broadly seen in the market these days. You almost know the market is going to be higher tomorrow and as long as Bernanke is in there with his “put” there is nothing to be too concerned about – not bad price prints and certainly not bad economic data….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.