Lots of data out this morning so let’s have a look:

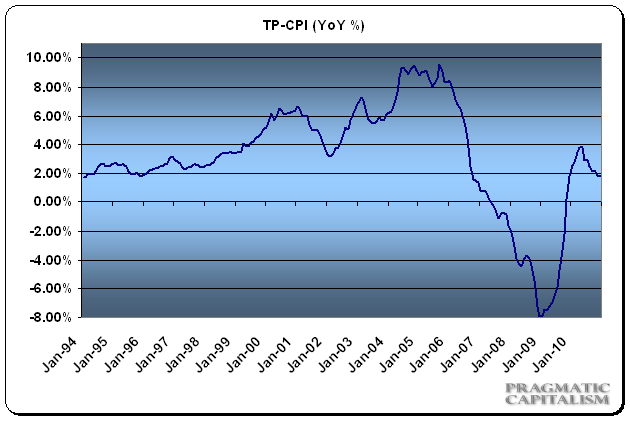

Inflation continues to come in benign despite surging commodity costs. Headline CPI came in at 0.5% versus expectations of 0.4%. Ex-food and energy inflation rose just 0.1%. My index (shown below) ticked slightly higher on the month, however, continues to show very low levels of inflation on a year over year basis at 1.75% (though higher than the government data).

This month’s CPI report showed a sharp uptick in fuel, energy and transportation costs. I presume that energy costs will continue to dominate the direction of the index. With a very strong seasonal period ahead of us it’s likely that there is an upside bias in the near-term for energy prices and the CPI report in general. In the current environment, however, higher prices paid on energy expenditures likely just means fewer new cars, new homes and other consumer spending in the year to come. The Saudi’s continue to have us over a barrel.

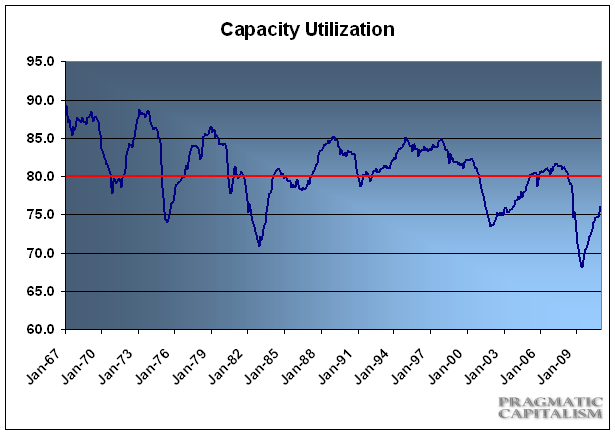

Industrial production and capacity utilization ticked up in December as the economy continues to heal. The Fed detailed the results:

“Industrial production increased 0.8 percent in December after having risen 0.3 percent in November. The rate of change for industrial production was revised down in November but revised up in September and October; the net effect of the revisions from July to November left the level of industrial production in November slightly higher than was previously reported. For the fourth quarter as a whole, industrial production increased at an annual rate of 2.4 percent, a slower pace than in the earlier quarters of the year. In the manufacturing sector, output moved up 0.4 percent in December with gains in both durables and nondurables. Excluding motor vehicles and parts, factory output increased 0.5 percent. The output of mines advanced 0.4 percent; the output of utilities surged 4.3 percent, as unusually cold weather boosted the demand for heating. At 94.9 percent of its 2007 average, total industrial production in December was 5.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 76.0 percent, a rate 4.6 percentage points below its average from 1972 to 2009.”

Utilities contributed substantially to the report, however, the trend continues to move in the right direction. As we near a healthy economy (generally considered 80+ readings) we will become increasingly inflation sensitive. For now, this data continues to confirm the current situation of keeping rates abnormally low and is consistent with an economy that remains far too weak. You’ll notice that current readings are not far from past recessionary levels:

Retail sales came in a little lighter than expectations. Econoday has the details on the report which appears to show signs of consumer spending slow-down in-line with yesterday’s Gallup report:

“Retail sales looked good at the headline level for December but there were signs of fatigue by consumers after ringing up the cash registers so loudly in November. Overall retail sales in December rose 0.6 percent after jumping 0.8 percent the month before. Although healthy, the December figure fell short of the consensus forecast for a 0.8 percent boost. Excluding autos, sales were not quite as strong, rising 0.5 percent, following a 1.0 percent surge in November. Analysts had called for a 0.7 percent gain. However, higher gasoline prices played a role behind face value strength. Sales excluding autos and gasoline rose a moderate 0.4 percent after a 0.6 percent increase in November.

Notable components include motor vehicles, up 1.1 percent after a 0.2 percent rise in November. There was a significant swing in general merchandise (which includes department stores). This component fell 0.7 percent in December after jumping 1.1 percent the month before.

Overall retail sales on a year-ago basis in December improved to 7.9 percent from 7.5 percent the previous month. Excluding motor vehicles, sales rose to a year-ago 6.7 percent from 6.4 percent in November.

The bottom line is that consumers front loaded holiday purchases (broadly defined core sales) in November and some softening in December is not surprising. But the softness was modest as sales were still healthy in December even after discounting some price effects. Consumers with jobs are now pulling their weight keeping the recovery going.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.