U.S. retailers posted weaker than expected sales in December, the Monster job index declined from last month’s highs and unemployment claims continued their steady trend lower. All in all it was a very mixed day of data.

- U.S. retailers posted weaker than expected chain store sales. Although weak, most retailers were still able to post year over year gains. But an alarming trend is showing up in the commentary – retailers are beginning to see margin compression due to rising input costs. Mark Montagna, a retail analyst at Avondale Partners says the entire supply chain cost is on the rise and cost conscious consumers are very sensitive to higher prices. The Wall Street Journal has a good round-up of the individual retailer results here.

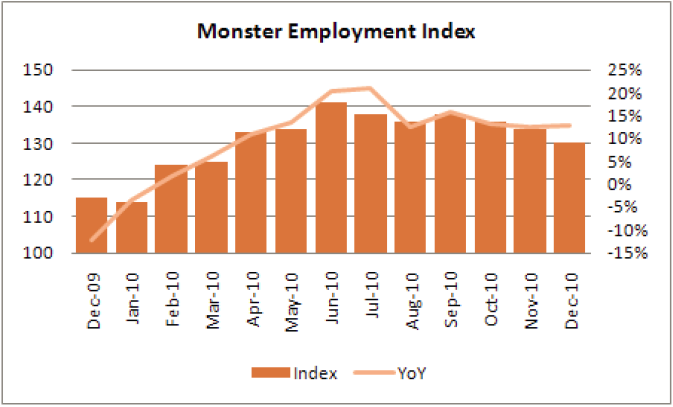

- The Monster Employment Index showed a stagnant employment environment. Though year over year growth remains strong the sequential data is showing little to no sign of recovery. The index slowed to 130 in December from 134.

- Unemployment claims ticked higher from last week’s huge drop, but remain on a steady trend lower. This likely points to growth, but slow growth in the labor market. Econoday has the details on the claims data:

“Jobless claims haven’t been too bumpy this holiday period, moving convincingly lower. Claims did rise to 409,000 in the January 1 week yet follow the prior week’s 391,000 for the second best reading of the recovery (prior week revised from 388,000). The four-week average is telling the story, down 3,500 in the week for a 410,750 level that is down nearly 20,000 from a month ago.

Continuing claims also continue to move lower, down 47,000 in data for the December 25 week to 4.103 million. The four-week average of 4.123 million is trending about 100,000 lower from a month ago. The unemployment rate for insured workers is unchanged at 3.3 percent.

Jobless claims data, not to mention ADP’s big call, are signaling solid strength for tomorrow’s big employment report.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.