The last few years taught us a lot about the field of economics. In fact, most of what we’ve learned has been the result of the enormous mistakes many have made throughout the crisis. For instance, the hyperinflation predictions helped shed some light on banking operations, the validity of the money multiplier concept, the idea that government spending leads to higher interest rates, the solvency of the USA, etc. These were big building blocks for a better understanding of the world. But did 2013 or the financial crisis “prove” any economic theory right? I am not confident that it did. If anything, it shot a few big holes in some theories (mainly Austrian economics), but that’s about it.

This is all interesting because there’s quite the battle occurring right now in the econoblogosphere over 2013. Scott Sumner declared 2013 a great victory for Market Monetarism. In doing so, he declared the proponents of fiscal policy wrong. Brad Delong and Paul Krugman took issue with that view (see here and here). There’s a bunch of issues here in my view:

1) Most academic economists are just policy analysts. In other words, they make very vague declarations about the actual future of the macroeconomy, but don’t maintain an actual forecasting track record. Paul Krugman and Scott Sumner aren’t doing what Jan Hatzius of Goldman Sachs does. Being a market analyst doesn’t come with tenure. So Policy analysts/economists mainly just talk about public policy and how policy variables can be used to understand the economy and influence future changes. So “proving” their work right is almost impossible because there isn’t actually a track record to study through which we can see whether their thinking is actually leading to better conclusions and better policy outcomes. There’s just a vague record of comments that may or may not lead one to validate something that was previously said. This is to be expected with policy analysts. They’re not in the forecasting game. They’re in the political sphere more than the market sphere (sorry “Market” Monetarists).

This is important because being a policy economist/analyst tends to come with some pretty serious political ideologies at times. For instance, Scott Sumner rails against Paul Krugman’s claims in 2013 that austerity would hurt the economy. I probably agree more with Paul Krugman’s views of the world than Scott Sumner’s, but on this one I very vocally said Paul Krugman was distorting reality. 2013 was never a year of real austerity in the USA. All of the diehard Keynesians who were warning about the sequester and the fiscal retrenchment were mainly pushing policy views and distorting the reality of what was going on. So I think we have to be careful about how we frame this discussion in the first place.

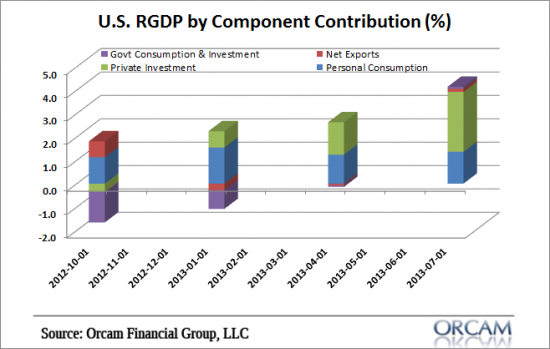

2) 2013 didn’t really prove anything except that maybe we’re all too focused on government policies all the time. After all, 2013 was the year where private growth really picked up the slack. Don’t believe me? Just look at the contributions to GDP in the last 4 quarters:

2013 didn’t “prove” fiscal policy or monetary policy right. In fact, if anything, I think it might have proven that policy economists give themselves way too much credit for economic outcomes driven by variables that their “theories” had less to do with than they think.

3) You didn’t need to be overly focused on monetary or fiscal policy to understand why 2013 turned out the way it did. I predicted it several years ago with a very basic framework of the macroeconomic landscape. That doesn’t “prove” my views or theories right. It just means that a moderately sophisticated understanding of the monetary system and banking system can help one understand the drivers of growth and put together a fairly coherent framework for forecasting and comprehending it.

If 2013 and the financial crisis “proved” anything it’s that policy economists probably give themselves too much credit for things they don’t deserve much credit for.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.