I was reading this article at a MMT website about the big bad finance industry. The post is pretty strongly worded and misleading in my view. The author claims that “the financial sector is the greatest parasite in human history”. He then goes on to claim:

“The job of the finance sector is simply to manage existing resources. It creates nothing. Therefore, the smaller the financial sector is the more real wealth there is for the rest of society to enjoy. The bigger the financial sector becomes the more money it siphons off from the productive sectors.”

Now, I have to begin by stating that I could be biased here because I obviously work in financial services and I don’t personally think that I go through life just leaching off the world and providing nothing useful for anyone. Then again, the author of that post is also in financial services so let’s just agree that we’re both on equal footing. Anyhow, back to the point.

When we begin to think about the modern capitalist economy we have to understand that we have a monetary economy. So, the way we engage in trade is via the use of financial instruments. Most of these financial instruments are distributed through the financial system via banks and investment banks and trade in real-time within the financial system in order to help us all understand the value of our financial instruments and manage the financial instruments which help us engage in trade. This system is central to the healthy functioning of a monetary economy.

While the finance industry may not produce any tangible goods it does certainly produce quite a bit. In fact, it is the financial intermediation via credit, fund raising, etc that greases the engine of consumption and investment. If you’re a renter who wants to purchase a home a financial intermediary makes that possible by connecting you with sellers and extending credit if you need it. If you’re an entrepreneur who wants to raise funding to start the next great company a financial intermediary will connect you to financial firms with capital or help you raise funds in any other number of ways. So no, to say that financial services “creates nothing” or that reducing its size necessarily means more “wealth” for everyone else, could in fact be entirely backwards. In many ways, finance is the oil that greases the engine of capitalism. To simply compare it to a “parasite” is an egregious misunderstanding of our monetary system and the role of the financial services industry.

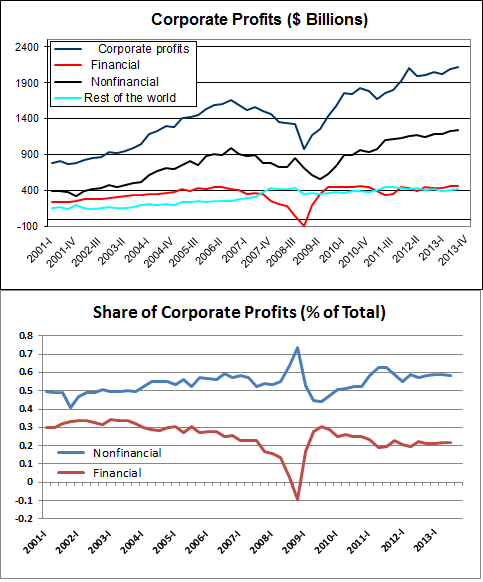

With regards to how the “parasite” is growing, well, the author again engages in political overreach to make his point. The finance sector isn’t growing anywhere near as fast as the rest of corporate America. In fact, corporate profits in the finance sector have been flat since 2008 and the share of financial profits as a percentage of total profits are DOWN since 2001:

Now, don’t get me wrong. The financial services sector could do a lot of things better. Personally, I think fees are way too high in my personal business (asset management), I think lots of fund managers are charging fees for something that doesn’t do what they promise, I think that investment banks sometimes engage in borderline corrupt behavior, that the financial lobby has an excessive grip on the legal system, etc. There’s also a strong argument to be made that the financial services sector could be smaller than it is (but I think technology is starting to take care of that anyhow so let’s not get ahead of ourselves here). So there is plenty to complain about in the financial services sector. But I also think we have to maintain some sense of balance in these discussions. There is a lot of good that comes from a healthy and productive financial services sector. So, to overlook it as a “parasite” which “creates nothing” is pretty counter-productive to our understanding and perspective.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.