Happy new year everyone. I hope it’s off to a bombastic start. Too early for that joke? Okay. Sorry. Anyhow, with the news in Iran and the potential of another war in the Middle East I wanted to discuss what this may or may not mean for portfolios.

The media will obviously whip you into a frenzy over this stuff. Remember, their job is to sensationalize everything and keep you tuned in. If the news was honest every day it would be roughly this:

“Some assholes did some bad stuff. The majority of people did good stuff. We all ate some food, took some shits and that’s about it. Tune in tomorrow for the same exciting update.”

Okay, that’s not exactly right. But you get the main point – in the grand scheme of things the world doesn’t really change that much every day. But wars are somewhat unusual event. After all, the USA hasn’t been involved in an armed conflict since…wait, we’re always involved in an armed conflict. Literally. America has been involved in an armed conflict almost its entire history. But specific geopolitical events do stand out so let’s look at the history of these events and see how they impact the stock market specifically.

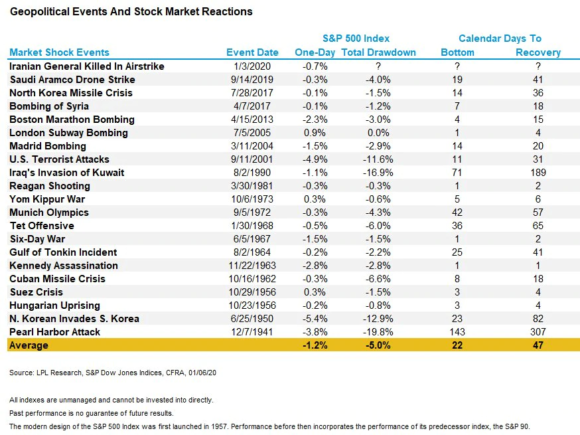

Here’s some short-term data from LPL on the stock market’s performance around major geopolitical events going back to Pearl Harbor. The short story is, fear sets in in the short-term and then subsides within a few weeks.

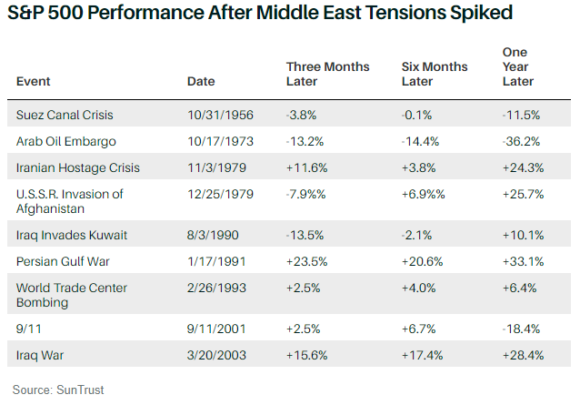

Here’s a longer perspective from Suntrust showing Middle East conflicts. The story is similar – over most longer-term periods the stock market ignores the event.

This all makes sense. The performance of corporate America is what drives stocks. And the drivers of US stock performance are factors that are much larger than any single armed conflict. In the long run those factors are what will drive the performance of corporate America and so these short-term geopolitical events might matter if you’re playing the time-the-market game, but for most of us who are just allocating our savings these events aren’t actionable and meaningful.

The same basic thinking can be applied to interest rates and bonds. Armed conflicts and geopolitical events aren’t likely to change the long-term direction of interest rates given that there are specific long-term factors that drive rates (demographics, technology, regulations, etc).

Try to remember that the stock market is very similar to a super high quality 30+ year bond and obsessing over the daily or weekly news events that impact this instrument is like watching a 12 month CD and wondering why it doesn’t change in price every day. It’s an instrument that is literally not designed to generate its cash flows over such a short time period. And given the long-term nature of the stock market and the relatively minimal impact of these Middle East geopolitical events on long-term market performance I wouldn’t get too worked up about this just yet.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.