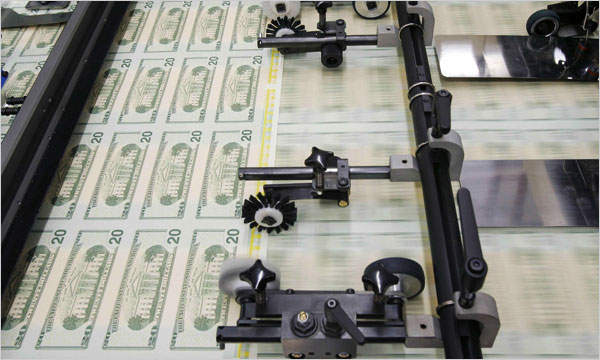

Don’t worry, the magical “money printing” myth that is “Quantitative Easing” isn’t ending any time soon. Of course, that all assumes that QE does anything in the first place, but more importantly, the idea of tapering makes a big deal about a measly $20B in monthly purchases. If you believe in the QE “money printing” myth then you need to fear not. Tapering doesn’t mean “money unprinting”. It just means less “money printing”. And in case you were concerned about less “money printing”, well today’s FOMC Minutes basically put a question mark around that one as well:

“While recognizing the improvement in a number of indicators of economic activity and labor market conditions since the fall, many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases.”

Of course, the unemployment rate stayed steady at 7.6% last month so we’re a lot further away from tapering than anyone assumes. And even when we start this grand “tapering” we’ll still only be printing less money according to popular mythology. So honestly, what’s the big fuss about anyhow?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.