Alcoa is about to kick-off earnings after the bell so it’s worth focusing on the topic that is likely to dominate headlines in the coming 8 weeks – earnings. Although the majority of the reports won’t hit the market for more than another week it’s useful getting some bearings on what’s to come.

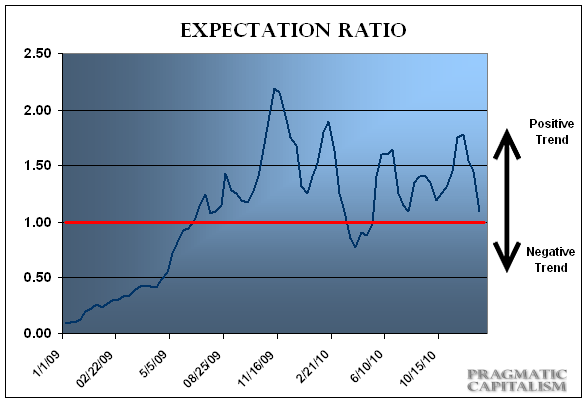

My preferred indicator of corporate earnings is my expectation ratio and it’s been remarkably accurate over the course of this entire investment cycle. It has been the primary indicator keeping me from making the same mistake that many investors made over the course of the last two years by staying permanently bearish. Even as the economy remained mired in trouble the corporate profit picture was improving dramatically (mainly at Main Street’s expense). In fact, this negative perception of the real economy compounded the positivity displayed in the ER by keeping expectations for future earnings at very depressed (wrong) levels. The result has been an unprecedented game of “catch-up” by investors.

The ER measures a broad set of forward looking metrics which are then compared to investor expectations. The result is one final output giving investors an idea of the future direction of corporate earnings. With the ratio currently at 1.45 we can expect another very positive earnings season. I’ll have a more detailed report out in the coming days.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.