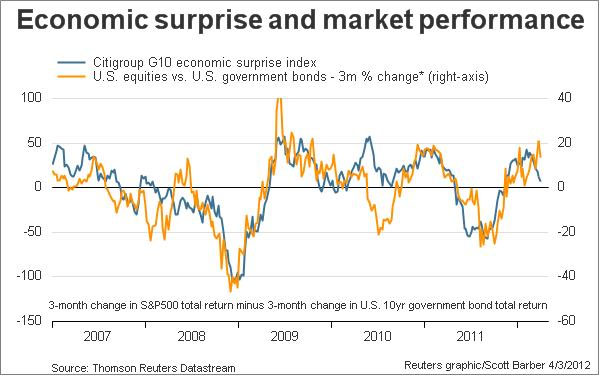

Here’s a very good chart from Reuters showing one of the dominant trends in the market performance of the last 5 years. It shows the 3 month moving average of the S&P 500 minus government bonds versus the Citi G10 Economic Surprise Index. The results show a very tight correlation and a clearly changing trend:

“Valuation may favor stocks, but in recent years economic sentiment appears to have been more significant in determining what investors actually decide to do. The relative performance of stocks and bonds has been closely correlated to the Citigroup G10 indicator of the economic cycle. The recent dip in the latter suggests that on a short-term basis, at least, bonds may emerge as the winners. ”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.