Back in 2007 Edward Leamer published a paper titled “Housing IS the Business Cycle“. This one turned out to be pretty timely as the paper was published as the housing market was already falling apart and slowly pulling the US economy into the dumpster with it. It’s an appealing perspective especially within the context of today’s weak economic growth. With a weak recovery in housing the national recovery looks weak. So goes housing, so goes the US economy.

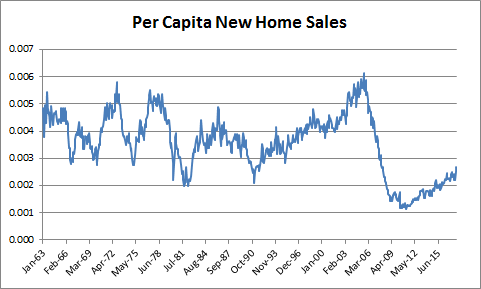

Today’s release of the surge in new home sales has people talking about a boom in growth. But I think we need to keep things in perspective. The financial crisis was an unbelievably damaging event. Here’s a look at new home sales adjusted for the change in population. We’re still at levels consistent with past recessions.

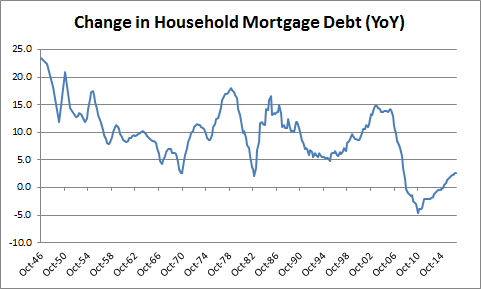

You can see the same basic story in household mortgage debt. This is important since, if the economy is comprised of balance sheets that expand over time in order to generate economic growth, then this is an essential element of growth since mortgage debt comprises 71% of household debt.

Here’s some general takeaways from all of this:

- When viewed thru the lens of housing the economy is trending in the right direction, but still far from a point where we can declare that it’s a boom.

- Housing is a local phenomenon so this data is relative. For instance, real estate in San Francisco and Austin has been booming, but other parts of the economy have been far more subdued. On average, it’s been relatively weak.

- This slow and steady growth is a solid argument explaining why the current expansion has been so long and why it could grow to be much longer.

- If we do see a recession it will likely come from a sector outside of a housing boom (stock market boom/bust?). That means it will likely be smaller in impact since any sector outside of housing won’t have as widespread negative impacts.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.