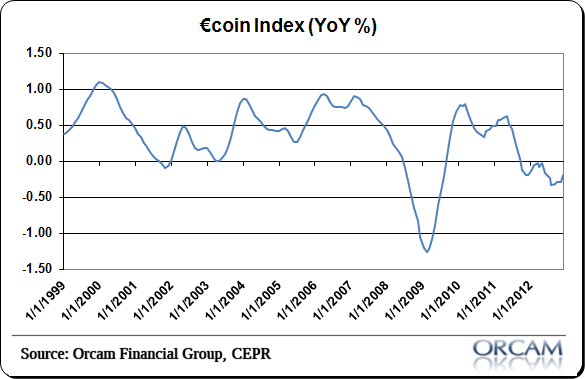

Just a brief indicator update here. The December Eurocoin index came in at -0.2 compared to -0.29 in November. That reading is still consistent with a contracting economy though marginally less so than previous readings and off the lows of -0.33 seen in August of 2012.

Here’s a bit more detail via Eurocoin:

-

In December the €-coin indicator remained substantially stable, at negative levels, for the fifth month running (‑0.27%, as against -0.29% in November).

-

The indicator was buoyed up by the results of the business opinion surveys conducted, which were less unfavourable than in the past, and by the easing of the tensions on financial markets; on the other hand the indicators of activity in the manufacturing sector continued to be weak.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.