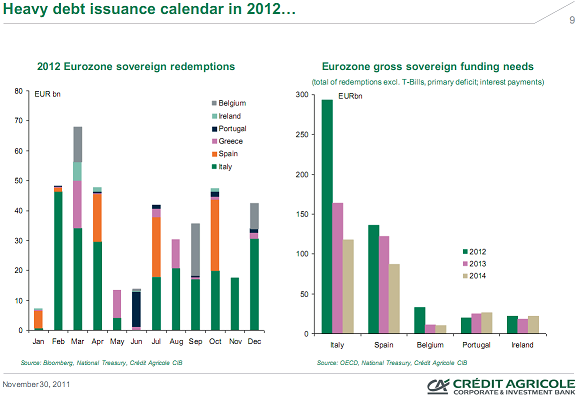

It’s still uncertain if this week’s summit will finally resolve the Eurozone sovereign debt crisis, but early reports certainly leave some doubts. If it should turn out that EMU leaders are not ready to fire a bazooka then the first quarter of next year will almost certainly fore the issue.

As Credit Agricole recently noted (see the chart below), the debt issuance calendar in early 2012 is heavy. But it’s particularly heavy for Italy. As we all know by now, Italy is where the road ends in this crisis. If Italy defaults the EMU as we know it will never be the same. In 2012 Italy has total debt redemptions of almost $300B. In the first 4 months of the year Italy has redemptions of $115B. This is going to kick the EMU crisis into overdrive early next year. If we don’t hear a sustainable and permanent fix later this week then prepare yourselves for early next year. This crisis is almost certain to reach a new crisis peak as EMU debt redemptions force the issue.

Source: Credit Agricole

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.