Just a brief follow-up on the bond bubble post….

A key aspect of any bubble is excessive euphoria. In fact, one of the key aspects of a bubble is that the market appears totally rational and the majority of investors agree that the asset price trends appear sustainable. This is, to a large degree, what drives the irrational pricing. Extrapolative expectations lead to unreasonably priced assets. But while many people continue to think that T-bonds are in a bubble we continue to see terribly bearish outlooks for bonds.

Here’s the latest big money poll results from Barrons. The line that really jumps out is that 91% negativity about US Treasuries. In fact, most bonds are viewed pretty negatively. And stocks are viewed positively. I’m not sure why that just about always seems to be the case, but 91% looks more than a bit unusual. And it certainly isn’t consistent with an excessive euphoria.

(Source: Barrons)

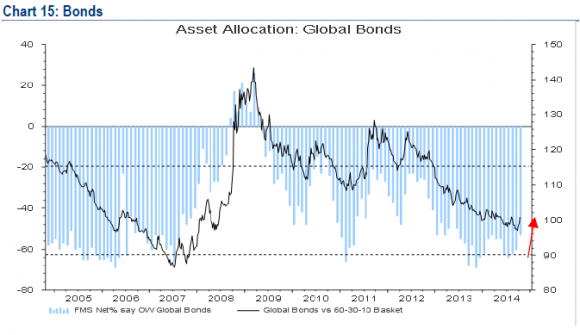

If we look at the latest Merrill Lynch Fund Manager Survey we find similar bearishness with a 53% underweight in global bonds.

(Source: Merrill Lynch)

The world’s biggest fund managers just don’t like bonds right now….Of course, this doesn’t mean bonds are some no-brainer bullish bet here. In fact, bonds are a lot less attractive today than they were even just 12 months ago. But the idea that bonds (especially US T-Bonds) are currently susceptible to some sort of Nasdaq circa 2002 style crash strikes me as a bit an extreme position.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.