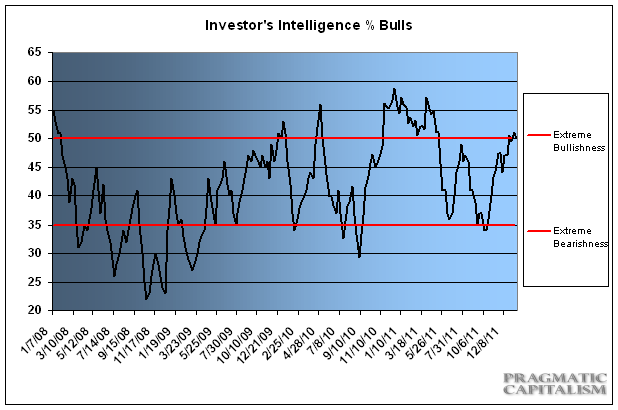

Like small investors (see here), advisors are largely bullish. It appears as though the fears of recession have now turned into a near unanimous optimism. The latest Investor’s Intelligence survey showed a slight decrease in bulls to 50%. This is still off the highs seen last April when equities peaked, but is still a historically high reading. II details this week’s report:

“The bulls decreased slightly to 50.0%, after reaching 51.1% a week ago. That was the most bulls since late April 2011 and what you would expect following the market’s 15% or so rally from early Oct, when the bulls were just 34.4%. The bulls remain below their April high at 57.3%, when many indexes achieved their yearly peaks. We are still not up to the 55% readings which are dangerous; bull market tops often include the bulls as high as 60%. The rising number of bulls over the last three months coincided with money moving into stocks. We are now getting close to readings where bullish sentiment is a worry. “

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.