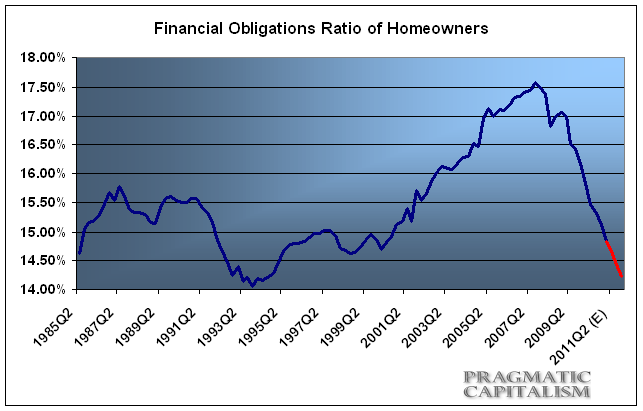

The Fed released their data on household debt and obligation ratios last week. The latest reading in the financial obligations ratio of homeowners shows a continued improvement to 14.84% in Q1 20111 from 15.13% in Q4 2010. This is down dramatically from the cycle high of 17.48% in Q4 2007 as the debt bubble was near its peak. As incomes have improved and debt levels have declined the environment for de-leveraging has become increasingly stable.

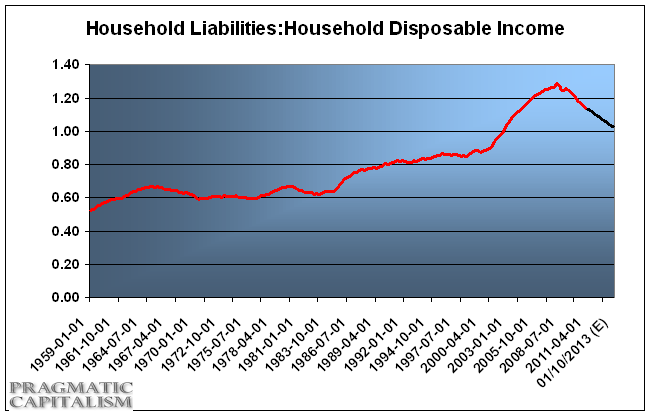

While the improvement in FOR shows that households are becoming increasingly creditworthy, the aggregate debt levels remain historically high when viewing disposable income to total outstanding household debt. You could even make a worrisome case that at the current rate of improvement, households won’t be able to shoulder a heavy recovery via increased debt loads for quite some time. In other words, the US economy could require persistent income growth and expansion in order to allow households to continue to expand their growth in aggregate debt levels. Fortunately, the burden is easing, albeit at a slow pace. Unfortunately, without substantial improvement (which could take years) we’re not yet close to a level where the private sector can substantially shoulder the burden of a debt boom (and a subsequent economic boom).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.