The implications of the balance sheet recession go well beyond public policy mistakes. As we’ve seen over the last few years, misunderstanding the disease has also resulted in massive portfolio mistakes (mostly by those who expected high inflation to hurt bonds). In a recent note Nomura touched on the BSR and its impact on fixed income:

“One reason that balance sheet recessions tend to last a long time is that deleveraging is not an overnight process. Leverage accumulates over time, and takes a while to unwind. As we discussed earlier, Japanese corporates began deleveraging in 1990 and have continued ever since. European and North American non-financial corporates began deleveraging around 2000.

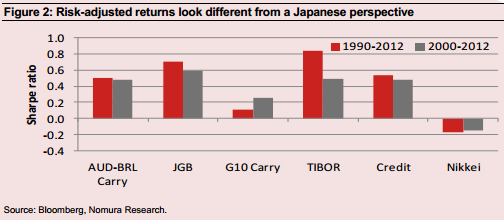

This has implications for asset returns. Deleveraging is bad for equities, but good for credit. Figure 2 shows how that effect played out in Japan. Equities delivered negative excess returns over an extended period of time. Credit outperformed, along with other fixed income asset classes such as FX carry and government bonds.”

Source Nomura

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.