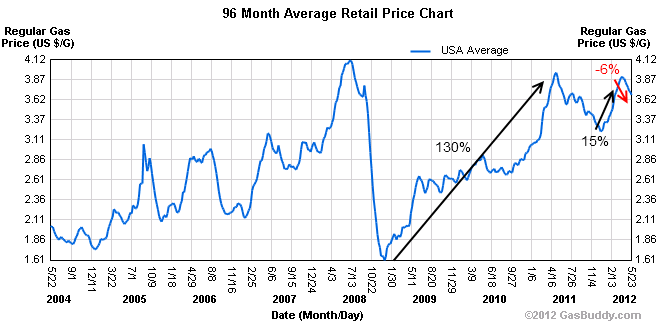

I keep hearing a lot of chatter about how falling oil prices are a big boost to the US consumer currently. And you’d think they would be given the 20% decline in oil prices since the March high. But national gas prices have only fallen 6% from their recent highs and just 11% from the all-time high set in 2008. Meanwhile, prices are up 130% since the trough in 2008 and up about the same amount over the 8 year period (see chart below via Gas Buddy). So, if anything, we’re right near the all-time highs and not seeing this dramatic boost to the consumer that some portray this to be.

Given, there’s a lot of moving parts here and gas prices tend to work with a lag from the faster declines in world oil markets, but the boost to the economy is not being felt in the here and now. So we’ll wait and see. If gas prices are sustained at lower levels then you’ll see the price at the pump drop much further, but for now the big drop in oil prices is not immediately translating into the big boost to the economy that everyone keeps saying it is…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.