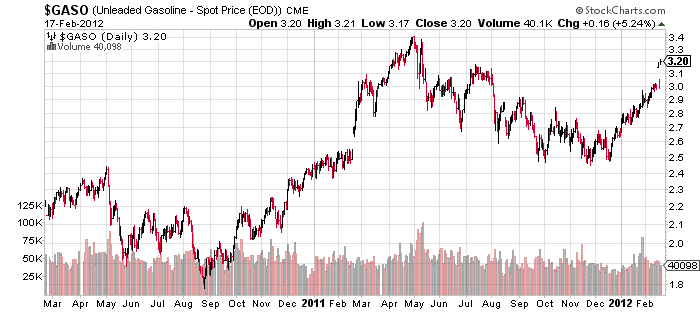

Here we go again…I’ll update the inflation outlook tomorrow, but this is the big risk I discussed to the disinflation outlook. Gas prices are surging again (via Huffington Post):

“At $3.53 a gallon, prices are already up 25 cents since Jan. 1. And experts say they could reach a record $4.25 a gallon by late April.

“You’re going to see a lot more staycations this year,” says Michael Lynch, president of Strategic Energy & Economic Research. “When the price gets anywhere near $4, you really see people react.”

…Higher gas prices could hurt consumer spending and curtail the recent improvement in the U.S. economy.

A 25-cent jump in gasoline prices, if sustained over a year, would cost the economy about $35 billion. That’s only 0.2 percent of the total U.S. economy, but economists say it’s a meaningful amount, especially at a time when growth is only so-so. The economy grew 2.8 percent in the fourth quarter, a rate considered modest following a recession.”

It’s a real shame that this country doesn’t have a substantial energy plan in place. The added volatility in the business cycle and the constant risk of cost push inflation suffocates policy options. But here we go again. If energy prices continue their push higher my theory of QE3 in June is dead in the water and the odds of a weaker second half economy will rise substantially….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.