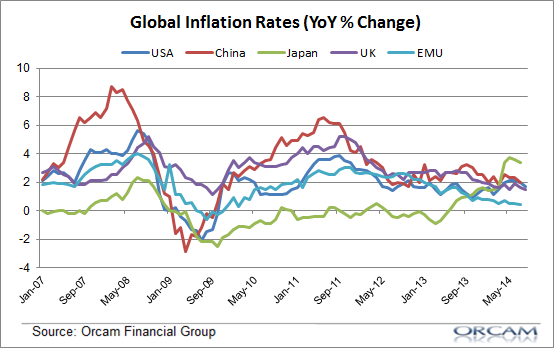

This strange new world of disinflation continues. Yesterday’s CPI reading in the USA came in at 1.7% which was down from 2%. Core inflation (minus food and energy) was also 1.7%. Most interestingly, this isn’t just a conspiracy by the BLS to manipulate the way inflation is gauged. We know that because inflation isn’t just low in the USA. It is low everywhere in the world.

The latest global readings on inflation show broad disinflation. The most notable of which is in Europe where we’re fast approach a full on deflation. Japan is the upside surprise in recent months with several 3%+ readings, but still nothing to write home about.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Suvy

This is what we should expect. The excess capacity around the world is collapsing, which means inflation is likely to fall further.

Geoff

Suvy, if excess capacity is collapsing, wouldn’t that mean we are approaching full capacity and, in turn, inflation?

John Daschbach

Once again Suvy gets it exactly wrong! All other things being equal, excess capacity, leads to disinflationary trends. One of the most common characteristics of economies that have suffered hyperinflation is a collapse in production capacity.

Suvy

How can you look at the impact of falling capacity on inflation if you don’t take a look at commodity/energy prices or worldwide demand? Falling capacity with falling demand and falling input costs creates a feedback loop that sends inflation and output lower

Geoff

You must be some sort of idiot Suvant because whatever you said went over my head.

Suvy

When you reduce worldwide production sharply, it makes sense for worldwide demand to fall right? Why? It’s cuz you’re reducing production and putting people out of work. There’s less demand because more people are laid off and that causes firms to reduce production more. The reason I bring up commodity prices is because falling production, employment, and demand will result in falling commodity/energy prices because falling production means you need less inputs. It all works in a feedback loop. Does that make sense?

Suvy

So correlation means causation?

John Harllee

I think we had better start taking the possibility of actual, sustained deflation seriously. I am not predicting deflation. Just saying that it the risk is no longer trivial.