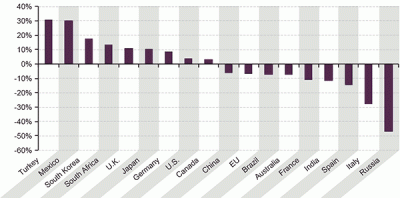

Interesting chart here. I sometimes post Warren Buffett’s favorite valuation indicator (GNP to market) cap. Guggenheim Partners brings us the global picture here:

“A country’s market capitalization as a percent of GDP is a useful indicator in assessing whether an equity market is under- or overvalued. Making direct comparisons between developed markets and emerging markets can be difficult, however, because the latter tend to have less developed stock markets and lower market capitalization to GDP ratios. A more useful indicator is to compare a country’s ratio to its historic levels. Based on current differences from previous 10 year averages, European markets, especially Italy, Spain, and France, appear particularly undervalued and therefore attractive. Additionally, the BRICs (Brazil, Russia, India, China) countries are currently below their averages, suggesting now may be a good buying opportunity.”

H/t Meb Faber

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.