I’ve attached some interesting thoughts sent to us via Societe Generale on the price divergence in gold and other major global commodities. Gold continues to behave as a hedge against uncertainty while most major commodities continue to trend with the global business cycle:

Gold and monetary stimulus

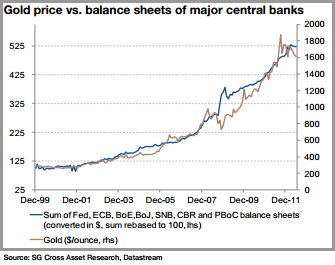

- Gold shows some correlation with the size of balance sheets of major central banks, as it is seen as a global currency and a hedge against money debasement.

- Some profit taking has lowered gold prices in the past month but current and future potential QE programmes from the Fed (QE3.5?) and the BoJ (QE9?) among others could send gold prices higher.

- Gold’s safe haven status could drive prices higher if renewed tensions were to materialise.

Oil, agricultural and industrial commodities

- Since September’s coordinated easing from central banks, commodities have turned in mixed performances (-5% for oil, -3% for metals).

- The direct impact of monetary policy on industrial commodity prices appears very limited today (contrary to the situation during QE2 period), given the bleak global economic outlook and the absence of aggressive easing from China.

- The oil price remains highly dependent on fundamental factors of global demand and supply (plus geopolitical risk). But massive liquidity injections in the economy may impact oil prices indirectly.

- The strong increase in soft commodity prices in 2010-2011 began before QE2, and was driven by significant supply issues.

Source: SG

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.