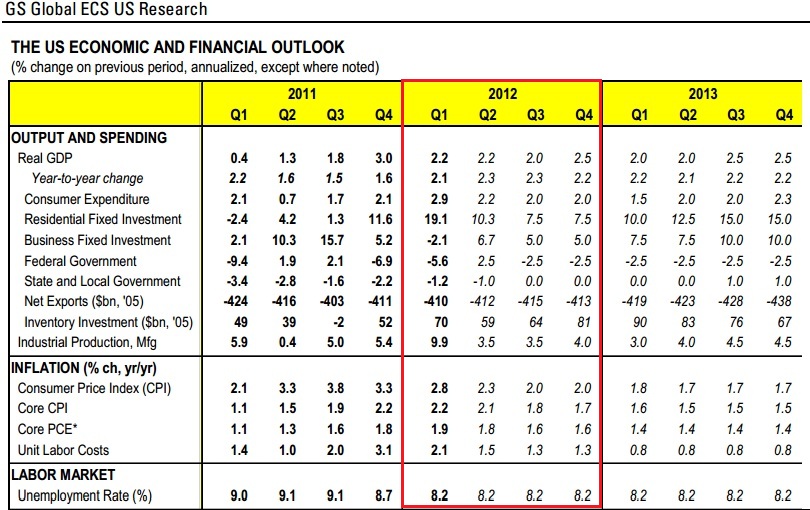

The latest economic outlook from Goldman Sachs is pretty similar to my current perspective – the economy will muddle through, but will not sink into recession. Goldman is forecasting about 2% growth for the remainder of the year and an elevated unemployment rate (via James Pethokoukis):

“We estimate 2.2% real GDP growth (annualized) in Q2 and 2% in Q3, slightly below the first-quarter pace. Incoming news on activity has been weaker than expected on net since the first week of March. We suspect that some of the recent softness reflects a “payback” after a boost to growth from unusually warm weather throughout the winter. … A slow recovery has started in the housing market. Home sales and residential construction activity have bottomed, and we expect positive growth over the next two years. However, gains are likely to remain modest, at least in the singlefamily market … We forecast that US house prices will slip another 1.5% this year before stabilizing in 2013. … We expect the unemployment rate to drift sideways, ending 2012 at 8.2%. Our forecast entails growth that is near the US economy’s potential rate this year, suggesting little progress reducing unemployment. We forecast that the labor force participation rate will stabilize this year, at least temporarily, as improving cyclical momentum offsets underlying weakness stemming from demographic trends.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.