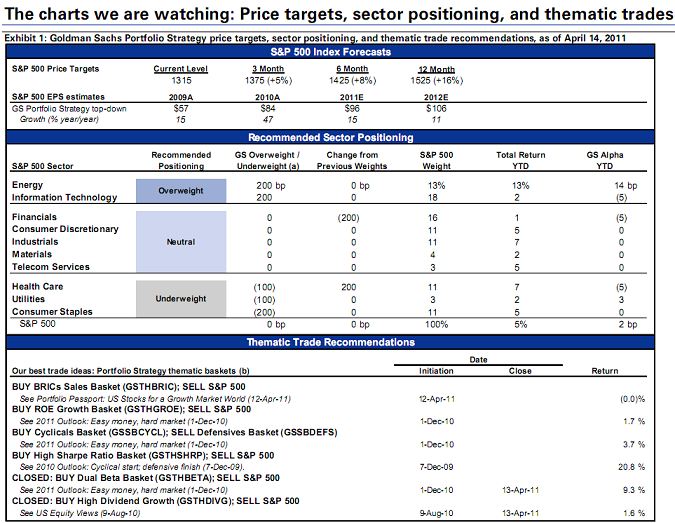

Despite their recent downgrade of Q1 GDP Goldman Sachs remains incredibly bullish about stocks. In their most recent strategy note, Goldman highlights the best ways to play the ride up to S&P 1525 (their 12 month target). They still like what is in essence a fairly aggressive high beta portfolio including BRICs and cyclicals (see here for more on their emerging markets plays):

“Our discussions with clients this week related to our continued pro-cyclical outlook for US equities. The core aspects of our positive outlook for US stocks remain in place. However, the distribution around our base case has widened since early December following a 9% rally in the S&P 500 and elevated risk to the US economic outlook from higher oil prices and inflation. Accordingly, we have shifted our recommended sector weights closer to benchmark and adjusted our thematic trade recommendations to gain more exposure to growth markets.

We (1) maintain our S&P 500 year-end 2011 price target of 1500 (+14%); (2) lower our Financials weighting to Neutral from Overweight and reduce the size of our Health Care underweight; and (3) recommend buying stocks with high BRICs sales <GSTHBRIC> and close our Dividend Growth <GSTHDIVG> and Dual Beta <GSTHBETA> trades.

We believe these changes are consistent with portfolio risk reduction during periods of uncertainty. Our S&P 500 3-, 6-, and 12-month price targets: 1375, 1425, and 1525. US Equity Views: New 3-, 6-, and 12-month targets reflect 5%, 8% and 16% returns (April 13, 2011). Our views reflect expectations of sustained US economic expansion, moderate inflation, and accommodating monetary policy, but recognize the increased risks of slower growth, inflation, higher oil prices, and interest rates. Our DDM-based 12-month target of 1525 reflects a 16% gain from current levels.”

Source: GS

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.