There have been lots of bottom calls in the housing market in recent months, but Goldman Sachs isn’t buying it. They say the housing market won’t bottom for at least another year (via Joe Weisenthal at BI):

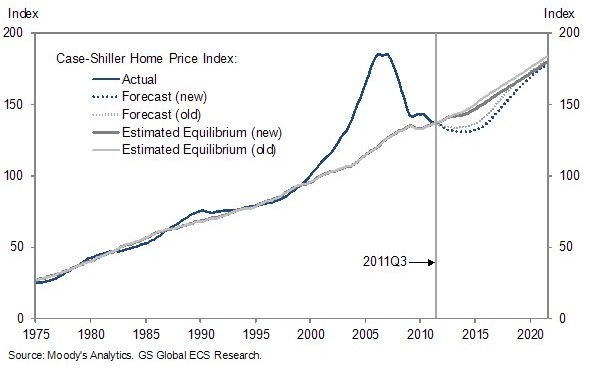

- In December 2011 we published a new house price model for 147 metro areas that pointed to a decline of around 3% from mid-2011 through mid-2012 before stabilizing in the year thereafter. Since publication of the model–which was based on Case-Shiller house price data up to 2011Q2–the decline in house prices has reaccelerated slightly. In today’s (February 29) comment we update our forecast in light of this and also use the opportunity to make a couple of technical changes to the model.

- We now project that house prices will decline by around 3% from 2011Q3 until 2012Q3, and by an additional 1% in the year thereafter. As a result, the expected bottom in house prices is pushed out from end-2012 to mid-2013. Although the house price outlook has weakened very slightly, we believe that the house price bottom remains in sight.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.