I’ve spent a lot of time in my career toying with regime change strategies. That is, strategies that operate one way in one regime environment and change in another. So, for instance, if you knew when a recession was going to occur you might downshift your portfolio to something less aggressive. Since recessions are pretty rare and often involve traumatic market environments you can be relatively passive, but still try to manage the risk in a portfolio. Then, the other 90% of the time when the economy is expanding you’re just super aggressive. Or something like that.

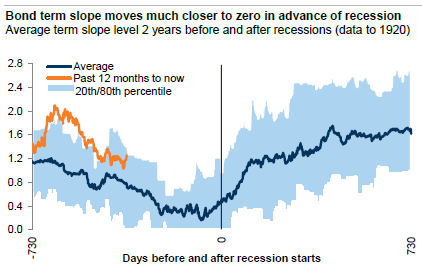

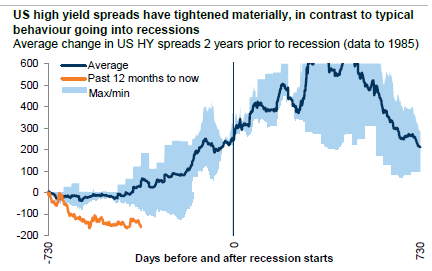

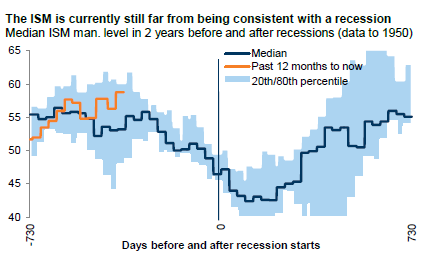

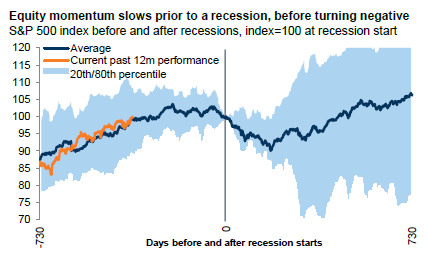

Anyhow, I always love tracking recession indicators for this reason. Oh, and the minor detail that recessions have huge policy and economic ramifications. So I found these charts from Goldman pretty eye opening. In essence, no signs of recession:

Source: Goldman Sachs Global Investment Research

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.