Goldman Sachs recently introduced a new metric for calculating economic growth. They claim the indicator is a more accurate reflection of the nation’s GDP and can be used in near real-time due to its intra-month updates. Well, that indicator is now falling off a cliff and pointing to downside risks for Q2 GDP. According to a recent note from Goldman Sachs, they are already concerned that estimates remain too hopeful for the upcoming quarter (via Zero Hedge):

“This morning’s data had minor implications for our assessment of real activity. Our Current Activity Indicator (CAI) for May moved up slightly, to 1.2% from 1.1% before the retail sales report. We continue to see downside risk to our 3% forecast for Q2 GDP growth, but these data did not affect our GDP tracking estimates.”

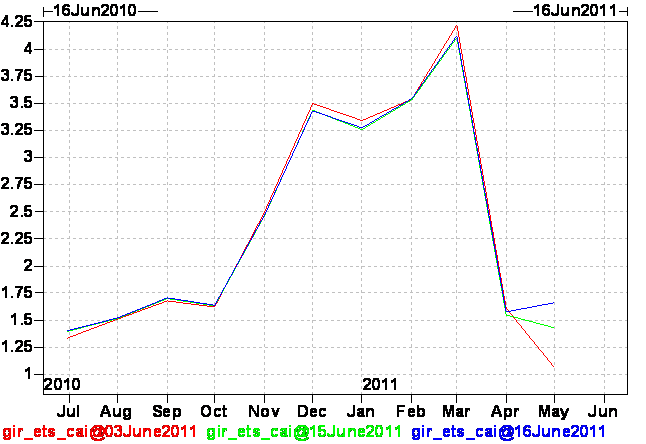

The following chart via Goldman puts the picture into perspective – economic growth is back to anemic levels. Perhaps the “recovery” was never really a recovery at all and just one big long recession? A balance sheet recession….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.