I found this section of GMO’s latest quarterly letter to be of particular interest. Grantham discusses a “prudent investor” portfolio that can provide decent risk adjusted returns in a tough environment:

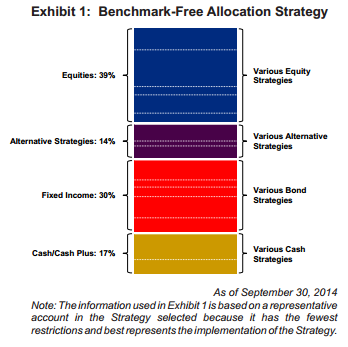

“Exhibit 1 shows an example of a portfolio that might be used in a world that excludes private equity and venture capital, and for a client who can do without a benchmark and can settle for owning a (hopefully) sensible long-term efficient portfolio. Efficient, that is, in terms of trying to minimize risk per unit of estimated returns. As always, and particularly in this type of overpriced environment, there are no guarantees of success even if every GMO recommendation were to be implemented for, regrettably, we too are often imperfect.”

Hard to say what all of that amounts to precisely, but it’s logical that “alternative” could be option based strategies since Ben Inker spent quite a bit of time earlier in the note discussing those approaches. Cash plus is just utilizing cash like a call option in all likelihood. It’s impossible to properly judge a portfolio like this because we don’t know the actual components, but my guess is that it would perform a lot like a 60/40 with lower returns and slightly lower risks. But that’s just a guess. Anyhow, lots of good moving parts there to think about. Read the full letter here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.