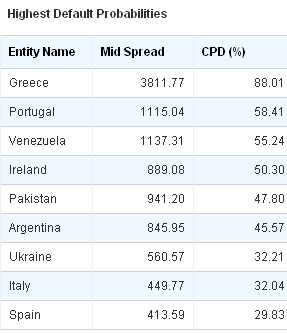

If we’re to take our cues from the markets then a Greek default is practically a guarantee at this juncture. The latest cumulative probability of default from CMA and the CDS markets is now 88% in Greece. This is also consistent with action in Greek government bonds which are now yielding a whopping 88% on a 1 year basis. I had to do a double take when I saw the Bloomberg quote.

Of course, Greece is only the appetizer in what has become an exhausting meal. The real concern across Europe is not whether or not Greece defaults, but how the EMU deals with the aftermath. If Greece is forced into some form of restructuring or default then we’re likely to see a rather violent chain of events. Credit markets will continue to seize up as concerns over liquidity sweep across Europe. This will be the equivalent of turning the austerity measures (which aren’t working and will not work) into overdrive as periphery bond yields will continue to move higher. Of course, the endgame here is Italy. If and when Italian bond yields surge, the country will be backed into a position similar to Greece. The ECB can continue their can kicking strategy by buying bonds, but that is only workable as long as the politicians allow it to go on. Ultimately, the situation is so combustible that this can kicking strategy must come to an end at some point. And that means we need a real workable solution and not these continues band-aids which provide short-term relief.

It’s hard to imagine a scenario where this doesn’t spiral into some sort of violent climax. The markets are going to force the Europeans into a very difficult decision in the coming 12 months. And that means one of two things – we fast forward towards a fiscal union or we dissolve the EMU as we know it. I don’t think we are moving in the direction of the latter. In fact, I don’t think it’s politically possible at this point. Too much has been invested in the creation of the EMU. Therefore, we are likely to move forward with a full union or fewer EMU countries (still ultimately ending in a union). I don’t know which direction we are headed, but the markets are beginning to account for a potential default and defection in Greece – a scenario I have long said makes sense in Greece, but will be avoided by the core at all costs. Because the EMU leaders are unable to create a solution in the near-term it’s likely that we are going to see significant collateral damage along the way. The markets are now forcing the EMU into its (necessary) end product.

The moral of this story remains the same as I described back in April – European assets of almost all kinds remain excessively risky.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.