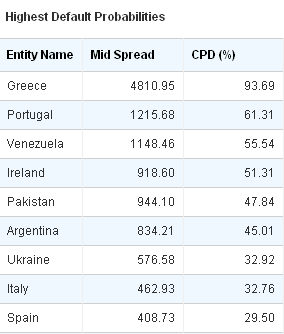

That’s the worry in the market as of Friday. If you look at CDS spreads from last week we see enormous moves across the board. And while Greece appears to be on the chopping block for some sort of haircut, it’s actually the other periphery nations that are becoming a concern. The markets appear to be telling us that if Greece goes then Portugal is next. And you can imagine where we go from there. Ireland, Italy and Spain are quickly moving up the list….

I did a very rare thing two weeks ago when I ignored a buy signal in my macro timing algorithm (a trade which, as of today would have still proven profitable). I’ve done that 2 times in the last 5 years. The other time was in September 2008 as the markets were falling apart. I am not implying that the market is set to crash here, but the risks are extraordinary. Political indecision has the European banking system teetering on the edge. I would go so far as to say that the risks are so enormous here that the water is simply not worth even dipping a toe into. As investors we have to recognize that we’re in the business of taking calculated risks and not risking capital based on a roll of the dice by politicians who don’t understand the magnitude of the issues they’re dealing with….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.