Here’s a clip from last night’s episode of Hard Knocks: Training Camp with America’s Worst Football Program.¹ In the clip Carl Nassib gives his teammates a lesson in investing:

He gets a lot right here and a lot wrong. Let’s cover each point:

1) Nassib starts off exactly right by slamming high fee financial advisors who charge 1% or more.

Yep, there are a billion financial advisors out there ready to charge you 1% per year. In my opinion, you should never ever pay 1% or more for financial advice. That sort of recurring fee destroys your long-term returns and there are reasonable alternatives that charge far less than 1%.

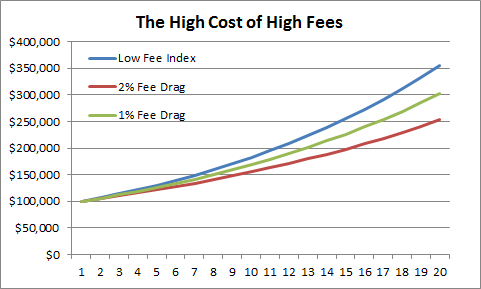

As I showed a few years back, the difference between low fees and high fees is tremendous:

“The chart below shows the impact of a diversified portfolio with an average annual return of 7% in a low fee index relative to the same portfolio with a 1% and 2% fee drag. Over the course of 20 years your $100,000 investment is a full 40% lower after the 2% fee drag and 18% lower with the 1% drag. In other words, over a 20 year period you’re handing over upwards of $100,000 for a service that is now being done by truly low fee advisors like my firm, Vanguard, Schwab and the Robo advisor firms.”

2) Nassib then goes into a description of compound interest describing how 10% compounded over 7 years will result in doubling your money.

Okay, this is true, but it’s also pretty misleading. In a potentially dangerous way. Here’s the thing:

- An aggregate bond index is currently yielding 3.1%.

- The earnings and dividend yield of the stock market has been close to 7.5% per year over the last 50 years.²

- A 50/50 portfolio of these assets can reasonably be expected to generate a 5.5% return going forward.

This is important because a diversified portfolio of stocks and bonds will generate HALF of what Nassib is discussing. And that doesn’t include taxes and fees!

It’s so important to set realistic expectations when we’re investing. Most people want the 10% part of the return equation and don’t realize that that comes with the risk of 50%+ declines at times since you need to be fully invested in stocks to achieve that. This is especially important for people like the young wealthy athletes in that room because they’ve essentially won the lottery. They don’t need to become billionaires. They already have more money than they’ll ever need. What they need to do is continue cranking, working hard, generating a high income and then allocate their savings in a prudent manner that generates a rate of return above the rate of inflation, but doesn’t expose them to stressful behavioral risks.

Unfortunately, young wealthy athletes (and most people in general) are susceptible to financial scams and the sales pitch from high fee financial advisors because that 10% return sounds a lot better than someone who tells you 5% is a more reasonable and practical return. Avoid these kinds of scams and high fees by setting realistic expectations. After all the portfolio that is appropriate for you will almost always be better than deceptive sales pitches about the optimal portfolio.

¹ – Sorry Cleveland! I just couldn’t help myself. I really hope you guys turn it around.

² – US stocks have generated closer to 10% historical returns in large part thanks to multiple expansion. Perpetual multiple expansion is not a practical assumption.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.