The main goal of this website over the years has been to search for an operationally sound and empirically supported perspective of how the monetary system works. I’ve debunked tons of myths in the process of this search, but the inflation truthers have been hard to convince for some reason. Strangely, there are still people out there who believe that the BLS lies about inflation stats and that all the data is manipulated. But I have some hard truths for the inflation truthers.

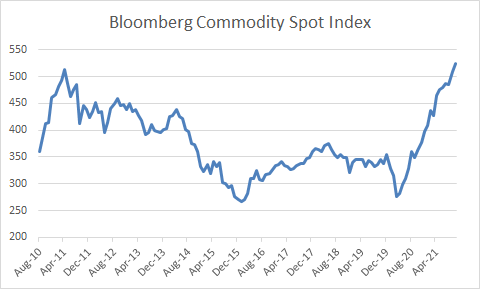

Hard truth #1 – Millions of traders are not wrong. When someone says that low inflation data is wrong they are essentially saying that millions of free markets are also wrong. For instance, commodity prices have been pretty stagnant for a decade. Are all of these commodity markets wrong?

Or what about the bond markets? Bond yields have collapsed in the last decade which is consistent with very low inflation. Are millions of bond traders and corporations just pricing their assets wrong for 10 years running? I find that very hard to believe. In fact, while I am no believer in efficient markets, I find it impossible to believe that they could be this wrong for this long.

Hard Truth #2 – GDP isn’t Negative. Nominal GDP has been very low for the last 10 years at an average annual rate of just 3.2%. If inflation has been high (for instance, the average Shadow Stats rate of 4.5%) then that means that Real GDP has been negative EVERY YEAR since the financial crisis. Said differently, that would mean that our economy has shrunk by 14% since 2008.¹

This is literally impossible. It doesn’t match up with any of the empirical evidence we have from other sources such as ISM, PMI, retail sales, corporate profits, foreign governments, trade data, factory orders, durable goods orders, NFIB data, etc. The economy might not be booming, but it’s patently wrong and unsubstantiated to argue that it has been shrinking.

I don’t think it’s controversial to say that the BLS data is imperfect. But that doesn’t mean it’s all a big conspiracy theory. Luckily, some common sense and some hard truths make that perfectly clear.

¹ – Funny story – At $175 ShadowStats shows that there is STILL deflation in hyperinflation newsletter costs.

NB – Updated with 2021 data.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.