Steve Williamson has a new post up arguing that Canada has successfully engineered an austerian recovery. I have a few issues with the post though.

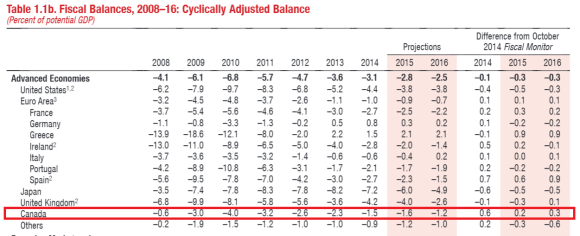

First, the extent of Canada’s “austerity” is somewhat controversial. According to the most recent IMF data on cyclically adjusted budgets the Canadian government is still running deficits and their deficit hasn’t exactly been dramatically declining in recent years:

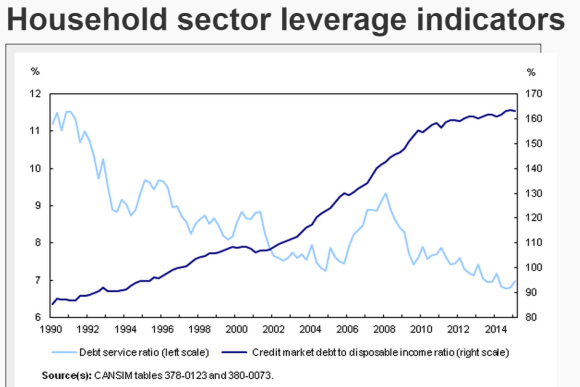

The second potential problem is that the government’s austerity appears to have shifted the debt burden to the private sector. As government spending has declined the household sector has picked up the burden by leveraging themselves up.

Will this turn out well? I guess we have yet to see. But we know from the experience in the recent financial crisis that high levels of household debt can lead to a boom/bust deleveraging. Will Canada avoid such an outcome from their explosion in household debt? It’s far too early to say. So, in my view, applauding the current Canadian “austerity” as a success is a bit of a rush to judgment.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.