Greg Ip has a piece in the Wall Street Journal arguing that the Fed has caused the US economy to slowdown. He says that the Fed has already started to tighten policy (by ending QE) which is leading to expectations of slower future growth which is hurting economic activity. There’s a couple of big problems with this thinking though:

- There’s no doubt that Q1 GDP is going to be weak. It is currently expected to come in at 1.5% which is less than robust. Let’s keep things in perspective though. GDP has only averaged 2.2% since 2010 so we’re not exactly talking about a huge shift in the rate of growth here….

- The Fed started to communicate the end of QE in the middle of 2014 yet growth came in above average or in-line in Q3 and Q4 of last year 5% and 2.2%). If the financial markets are forward looking and viewed the end of QE as tightening then surely this would have been priced into break-even rates and other markets sooner, right?

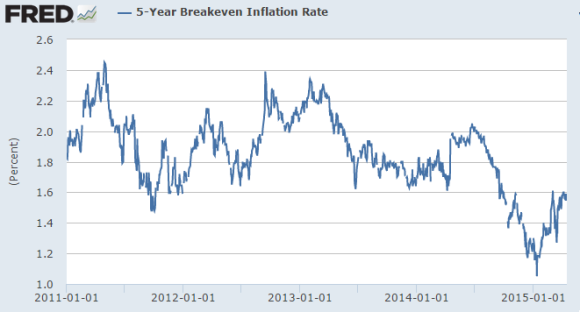

- Break even inflation rates have been in decline since 2011. And have actually risen since 2015 began. This means that financial conditions have eased in the near-term, but the longer-term picture says nothing helpful about the impact of QE on inflation expectations.

- The Goldman Sachs chart that IP cites shows an oil adjusted financial conditions index as well. This index shows no change in financial conditions since last June. Unless we’re assuming oil has not impacted the economy at all then I don’t know why we would ignore this adjusted index?

- The whopper is Europe though. If the Fed is causing a slowdown because they’re ending QE then surely the ECB would be causing higher growth as they ramp up QE. But the data shows that Q1 GDP in Europe is going to be even worse than in the USA. So the Central Bank clearly can’t be causing the slowdown in either country.

This doesn’t mean these Central Banks are having no impact on future growth with their various iterations of QE. But I think economists have a tendency to try to imply that Central Banks are steering the economy with their various actions. I just don’t buy the story that Central Banks steer the economic ship to the extent that many economists seem to believe. And the contradicting stories in the USA and Europe at present would appear to prove that to be emphatically true.

* This post has been corrected for an initial error in the break-even chart.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.