Nate Silver’s new website FiveThirtyEight is out and Paul Krugman and Tyler Cowen are not impressed. I think it’s WAY too early to write them off, but what’s more interesting to me is that they both took pot shots at a piece by Ben Casselman on corporate cash levels. Casselman was making a simple point in the piece – be skeptical of the motives behind any economic narrative because the evidence used in many of these pieces can be highly suspect. In this specific case, Casselman points out that the narrative about corporate cash levels have been misleading to some degree. And I think he’s right even if his piece didn’t flesh this out in the sort of excruciating detail that Cowen and Krugman expect.

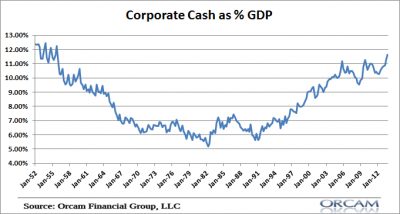

Basically, the “corporate cash” narrative over the last 5 years is an anti-business one which claims that businesses are making gobs of money, but they’re not spending it. But you could spin this narrative however you wanted to. For instance, if I took cash (defined here via the Fed’s Flow of Funds as liquid short-term assets) as a percentage of GDP then I could claim that businesses are hoarding cash:

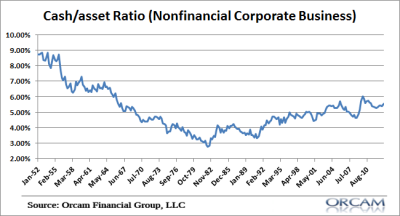

Or, if I wanted to make this picture look a lot less rosy I would post this chart of corporate cash relative to their total assets. As you can see, this doesn’t look quite as convincing for the “corporate America bad” crowd:

Or, if I really wanted to make the picture look bad I’d post cash relative to debt levels. Anyhow, you get the point. But the purpose behind the misleading narrative was that corporations weren’t pitching into the recovery. In other words, the people who have obsessed over high corporate cash levels were trying to paint corporations as the beneficiaries of the recovery and detract from any contribution they might have had. But the reality is that gross private domestic investment has averaged 9.4% year over year growth since 2010 and that means corporate America has played a huge role in helping to boost the American economy. Could corporations be spending and investing more? Of course. But let’s also not forget that during a period of de-leveraging it’s been the corporate sector and the government sector that have carried the burden primarily. Both probably could have done a lot more while the household sector was paying down debts and de-leveraging. But if both had done nothing it’s almost guaranteed that we’d be in a much bigger hole than we are today….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.