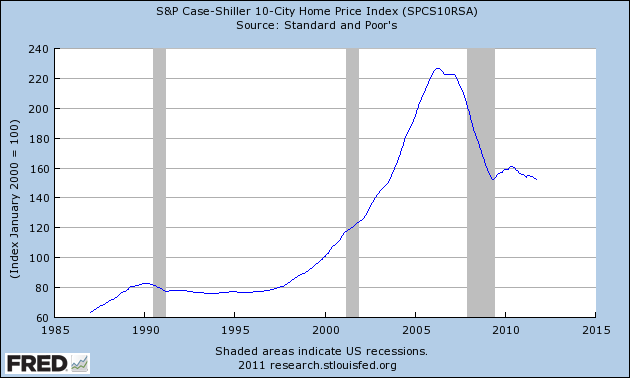

Home prices continued to decline in November according to the Case/Shiller home price index. The annualized rate of declined worsened to -3.6%. This is probably the most apparent sign of the balance sheet recession’s continuing effects. Consumers are still on one knee….more via Standard and Poors:

“Data through November 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed declines of 1.3% for both the 10- and 20-City Composites in November over October. For a second consecutive month, 19 of the 20 cities covered by the indices also saw home prices decrease. The 10- and 20-City Composites posted annual returns of -3.6% and -3.7% versus November 2010, respectively. These are worse than the -3.2% and -3.4% respective rates reported for October.

“Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall. Weakness was seen as 19 of 20 cities saw average home prices decline in November over October,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “The only positive for the month was Phoenix, one of the hardest hit in recent years. Annual rates were little better as 18 cities and both Composites were negative. Nationally, home prices are lower than a year ago. The 10-City Composite was down 3.6% and the 20-City was down 3.7% compared to November 2010. The trend is down and there are few, if any, signs in the numbers that a turning point is close at hand.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.