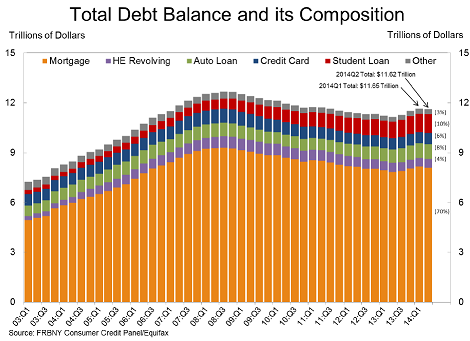

The situation in household debt remains tepid according to the latest household debt report from the NY Fed. According to the report Q2 household debt fell slightly:

“Aggregate consumer debt was roughly flat in the 2nd quarter of 2014, showing a minor decrease of $18 billion. As of June 30, 2014, total consumer indebtedness was $11.63 trillion, down by 0.2% from its level in the first quarter of 2014. Overall consumer debt still remains 8.2% below its 2008Q3 peak of $12.68 trillion.”

Mortgages, the largest component of household debt, accounted for the decline:

“Mortgages, the largest component of household debt, decreased by 0.8%. Mortgage balances shown on consumer credit reports stand at $8.10 trillion, down by $69 billion from their level in the first quarter. Balances on home equity lines of credit (HELOC) also dropped by $5 billion (1.0%) in the second quarter and now stand at $521 billion.”

Outside of housing there was a broad gain in household debt:

“Non-housing debt balances increased by 1.9 %, boosted by gains in all categories. Auto loan balances increased by $30 billion; student loan balances increased by $7 billion; credit card balances increased by $10 billion; and other non-housing balances increased by $9 billion.”

The continued weakness in housing is a direct extension of the weak consumer balance sheet. It’s a worrisome sign to say the least. While the de-leveraging appears to be ending (or at least slowing) there are still substantial signs of fragility at work.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.