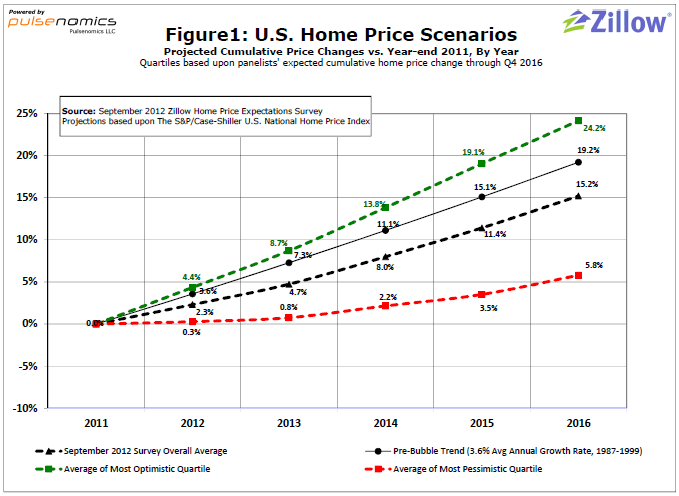

Here’s an interesting housing survey from Zillow. You’ll recognize many of the names listed on the most optimistic and pessimistic list, but what I find most interesting is how even the most pessimistic group is back to essentially saying housing can never fall in price. You’ll notice that the most pessimistic quartile is calling for housing appreciation in the coming few years. As Zillow notes:

“Figure 1 shows the forecasted, cumulative home price changes by quartile among panelists. Even the bottom quartile shows that opinions have turned much more favorable, with an appreciation of 0.3 percent forecasted for 2012, while the top quartile predicts an appreciation of 4.4 percent by year’s end.”

And you can see the discrepancy even more clearly in the list’s most optimistic and pessimistic analysts where the top 5 bulls are all calling for 20% appreciation while there’s only ONE bear calling for a 10%+ decline:

I’m surprised at how quickly the optimism in the housing market has turned. We seem to be moving back into the pre-bubble mentality that housing prices never decline….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.