I have to admit that I’ve been a little bit shocked by how quickly people are concluding that the Euro needs to be scrapped entirely. I’ve been very critical of the Euro for the last 7 years here and I even said Greece should leave a long time ago (before their depression), but I’ve also maintained that the path forward for Europe is unity, not collapse. The reason why I say this is simple – hyperglobalization, technological advancements and geographical proximity will FORCE Europe to unite over time. You can kick Greece out of the EMU, but you can’t move it to Timbuktu. Increasing economic unity is a necessity, not a choice.

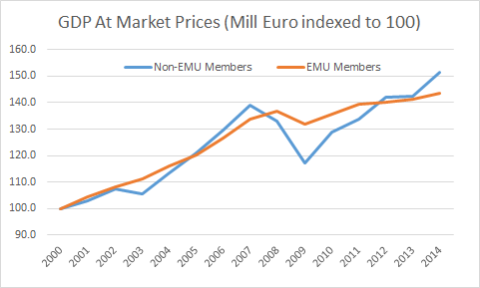

The thing that’s shocking to me is that the turmoil in Greece seems to be enough on its own to convince many people that the Euro as a whole is a complete failure. But we should keep things in perspective here. Imagine that – an economy that is 2% of Europ’s GDP goes through some turmoil and that means the whole 100% is dysfunctional! Yes, Greece and many of the other current account deficit countries are the biggest losers here. But something also seems to be amiss across all of Europe. After all, how can you explain the poor economic performance of the entire region? If we look at the GDP of the non-EMU EU members it becomes clear that, since the financial crisis, their economic performance hasn’t been all that strong either. There have been a few small outlier countries (notable standouts are Bulgaria, Czech Republic and Romania), but all of the larger non-EMU EU members have struggled including Denmark, Sweden and the UK. Having your own currency in Europe has not been a panacea even though it’s eliminated the solvency concern that exists in Greece.

My point here is not to downplay the extent of the pain that is occurring on the peripheral level. I think the degree of austerity that Greece experienced was excessive and resulted directly from a flawed monetary union and a poor policy response. But the economic performance of Greece and the EMU area as a whole is not evidence that the Euro has failed or should be torn apart. When viewed in the proper context it is simply a sign that the EMU is deficient as it currently is. But the broader data also shows that the period after the financial crisis has been unique and being a non-EMU member of Europe has hardly been a saving grace.

Perhaps I am too optimistic about the cultural divide here, but I think Europe needs to figure out ways to become more united, not less. The Euro can work well if Europe’s leaders are willing to work together to make it work. Of course there will be trying times like we’re seeing now. The complexity of this monetary union should not be overlooked. But this episode is no reason for all of this rhetoric about tearing apart the Euro. That is a regressive and counterproductive view. We should be more forward looking here and realize that Europe, one way or another, is going to become more united. And the sooner they realize this the sooner they can get to a more balanced union that better balances its inevitable imbalances.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.