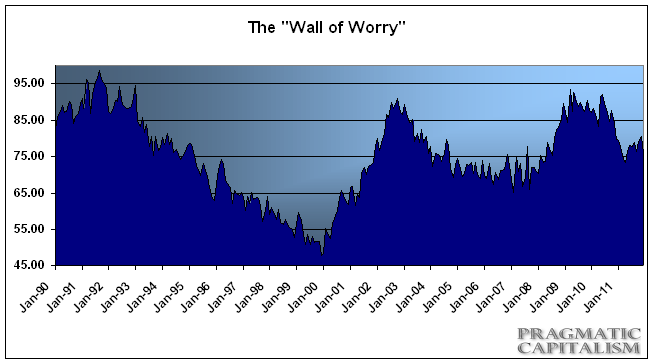

Investor sentiment tends to move in broad cycles. One of my favorite ways to gauge this cycle is using my Wall of Worry indicator which sums a number of different business and consumer sentiment surveys in order to gauge the long-term view on the level of fear in the markets at any given time. Since it’s been a while since I last updated the indicator it might be useful to put things in perspective.

The indicator has been very useful over the last 20 years in gauging long-term market bottoms, but has been less useful gauging tops. The latest reading of 76.2 is a relatively neutral reading when compared to the last few market cycles. Fear levels have come way off their 2010 levels and only spiked a bit during the most recent recession scare. Big bottoms have tended to occur over readings of 90. Recent readings are far from those levels, but also not nearing past levels of complacency. Sp I don’t think it’s safe to say that investors are becoming complacent just yet though. I would want to see readings in the low 60’s or below before beginning to feel really uncomfortable about the shrinking “wall of worry”.

In short, the wall of worry is still there, but it’s not nearly as high as it has been in recent years….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.