Morgan Housel has a very good piece in the Wall Street Journal highlighting the importance of understanding the impact of fees on your portfolio. He highlights a point that I have discussed in the past – high fees are a much bigger drag on performance than most people think:

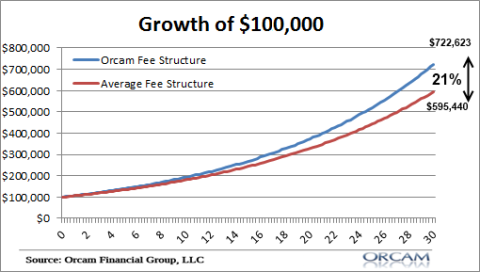

lowering your fees are one of the few ways to guarantee a higher return. For instance, my asset management service is just 0.35%. if you invested $100,000 in two portfolios that earned 7% per year, the industry average of a 1% fee will result in a balance that is $127,000 less than Orcam’s 0.35% fee structure over a 30 year period. In other words, paying a high fee for asset management reduces your total balance by over 20%.

But Morgan gets into a more important topic – the opaque nature of the fees on Wall Street. Specifically, the fees you pay in your brokerage accounts and retirement accounts are often pulled out of your account without the investor even noticing. It’s almost like Wall Street has its hands in your wallet without you knowing. An investor could be paying 2% or more of their returns to an advisor or fund manager without ever realizing it just because the fees disappear from their account like a wire transfer in the night. So, where should you look for these high fees?

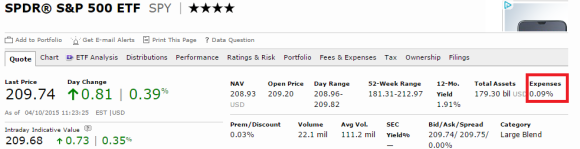

- Always review the expense ratio of any funds you’re using. You can do this simply by going to Morningstar and looking at the “expenses” in the quote profile.

- If you work with an advisor they are required to list their fee structure on their regulatory forms. Go to the SEC website and search for your advisor’s fee structure. Better yet, call your advisor and make them tell you precisely what the rate is.

- If you contribute to a 401K plan your plan administrator is required to send you a detailed expense report. Look at the expenses, ensure you’re using low fee funds inside your plan and if your plan administrator is charging high fees (1%+ or more) then contact the head of Human Resources and give them a wake up call about how they’re helping to piss away your retirement funds.

- Know your commissions and other account fees. There’s no reason to be paying annual account fees or high commissions these days. Review your brokers other fees so you know you’re not getting gouged. Your broker should disclose this on their website or on your account statement. There will be a specific line item on your statement that lists fees and other charges. If you use an advisor remember to look for a quarterly fee (it will only show up once every third statement and then multiply that figure by four for your annual rate). Also remember that commissions might not be listed here so ask your broker what their standard commission rate is and how often you’re being charged this fee.

- The biggest red flags in an account are churning. This involves excessive turnover of your portfolio in any month or year. If you see lots of turnover in the portfolio then consult an outside expert immediately for a review of the portfolio.

- Do not fall for the myth that an advisor using “passive indexing” is necessarily low fee. Remember, if your advisor charges 1% per year using low fee index funds then you are paying 1% PLUS the index fund fees. THIS IS NOT A LOW FEE APPROACH! It’s nothing more than a different version of a high fee strategy.

- As a general rule of thumb, do not use funds that cost more than 0.5%. There are exceptions to this rule (for instance, when an index doesn’t provide a reasonable alternative), but you’ll be well off sticking to this rule 95% of the time.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.