If you study economics and finance you’ll find a consistent battle between certain camps – the hard money camp and the fiat money camp. The hard money camp is characterized by people who think that the economic system should be based on “real” assets and that the monetary system should be linked to a physical form of money like gold. Similarly, they tend to veer towards a portfolio allocation that is based on “real” assets like commodities and hedges against exposure to “fiat” assets. The fiat money camp is characterized by people who view money as a simple medium of exchange and a technological advancement allowing for an elastic money supply that can better suit the needs of an increasingly complex financial world.

One of the biggest differences here is the view of money as a form of human innovation. The hard money types want us to revert back to a system that they claim worked better in the past. The fiat money types tend to understand that money has evolved because the old system was an antiquated technology. And those who understand that money is endogenous understand that it is truly the private sector (and not the government) that makes the most important innovations regarding “money”. Luckily, several factors show that the hard money types are losing the war on the future of money:

- Even hard money types are evolving on the monetary front. The rise of decentralized forms of money like Bitcoin show that the hard money types are moving beyond the idea of a physical money. The new technological reality has forced the hard money types to evolve and become something that more closely resembles the fiat money types. The debate here has moved beyond the metallist debates of old and into the political and technological realm.

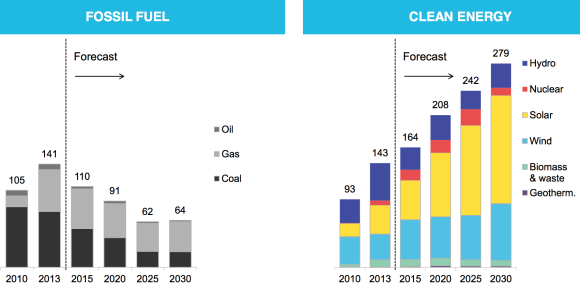

- On the economic front the hard money types are fast learning that theories like “peak oil” and the limits of real resources are not going to stop human progress. The future is coming. And it is not a commodity based economy. It is a world based on renewables, intangibles and intellectual property. As this Bloomberg piece showed the progress beyond the petroleum based economy is real and it’s occurring because of human innovation. Although commodities will always play a central role in our economy the economy of the future is proving that it is not constrained by that which is tangible.

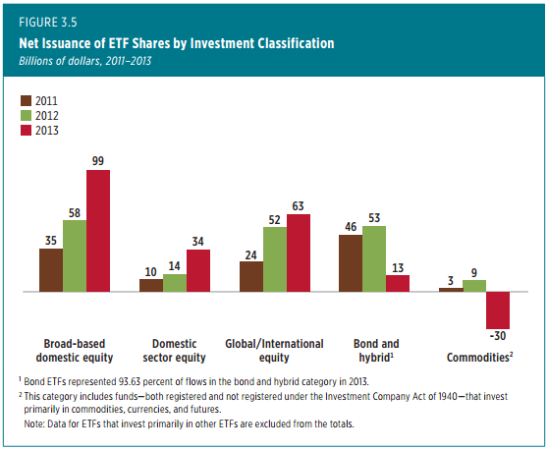

- On the portfolio management front there is less progress, but I am confident that more and more people are coming around to the view that commodities are not real “investments”. As I’ve shown repeatedly in the past, commodities are cost inputs in the capital structure. They correlate with the rate of inflation, but as an asset class they should not outperform the rate of inflation over long periods of time. Viewing commodities as an “investment” is erroneous. Therefore, constructing a portfolio around commodities is flawed thinking. The number of new commodity ETFs declined in 2013 for the first time in the last few years, but who knows if this is a long-term trend or just a blip. My guess is that it’s a blip. Commodities as an asset class aren’t going away, nor should they. But I do hope that people increasingly understand that buying commodities is a speculative endeavor rather than a long-term purchasing power protection endeavor.

The obsession with hard money is an antiquated view. We would all be better off accepting the technological advancements that we’re seeing across the economic system. And that includes the forms of money we use. Unfortunately, much of this debate seems to be bogged down in politics and the view that the government “prints money” or can “debase the currency” (which are largely misguided views for reasons I’ve explained before – see here and here). Luckily, knowledge and human innovation appear to be winning out over ideology. Let’s hope the trend continues.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.