There’s an economic battle occurring over whether Greece should leave the Euro or not. Economists on the left tend to say they should leave, bring back their old currency and go their own way. Economists on the right tend to say that Greece should stick it out and hang with the Euro. I like to think I don’t generally find myself on a “side” and here’s a pretty good example of that.

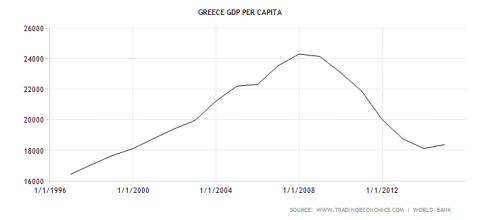

5 years ago I said Greece should definitely leave the Euro. My basic reasoning was that full integration is not going to happen and Greece will have to suffer through depressionary deflation in order to allow an internal rebalancing of their economy to occur. That view has turned out to be pretty spot on. Greece has undergone a modern day depression by any standard. And if they’d brought back the Drachma many years ago they could have avoided a lot of the deflation and depression.

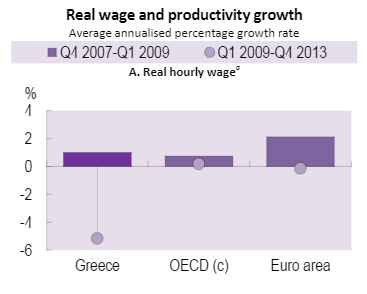

This is no longer the situation we’re in. Greece has already undergone a substantial internal rebalancing. They’re one of the only Euro Area countries where wages have actually FALLEN in the last 5 years. And they’ve fallen quite a bit in relative terms:

(Avg Annualized wage growth via OECD)

(Avg Annualized wage growth via OECD)

Now, the economists on the left say that Greece should leave because their new currency will make them so much more competitive. But I am not so sure that’s the right move at this point. The time to leave was before the depression set in. Not 5 years after it set in. And the reason why is simple. At this point Greece faces no good options. Staying in the Euro is going to very likely involve low growth and further austerity. But the alternative looks perhaps more frightening at this point. And the alternative is a high inflation and perhaps even a hyperinflationary nightmare. In fact, if there was ever a recipe for hyperinflation then Greece meets all the criteria.

The problem is multifaceted:

- The Greek economy is too dependent on foreign exports.

- The Euro will still be the dominant currency inside of Greece given that it’s largely a services and travel based economy. They will have, at best, a dual currency system.

- Their tax system is defunct.

- Their current budget promises will not be met via tax receipts.

- Their bonds will not be in high demand in the near-term for obvious reasons.

All of this means that Greece will have to fund its spending by harnessing its central bank. And this means they could be on the verge of a hugely inflationary environment. They could offset some of this through harsh government policies including austerity and a balanced budget, but the whole point of this charade is that they don’t want more austerity. There’s a good chance that bringing back their own currency will not only result in austerity (by necessity), but it will also result in sky high inflation. In essence, they will have won nothing.

This isn’t unfamiliar territory for Greece. After all, prior to joining the Euro, which brought unprecedented price stability to the Greek economy, they were in a perpetual inflationary tailspin. Worse, the Greek economy appeared to be growing a bit prior to the Syriza government renewing this crisis. That was largely due to the internal rebalancing that had occurred. This doesn’t mean the prospects for growth were/are strong, but we’re at a point where the Greek government has to choose between a few more years of low or slow growth with the hope of greater Euro integration. OR, they can roll the dice, go their own way and return to what will likely be a disastrous high inflation environment that could leave them worse off than they are today.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.