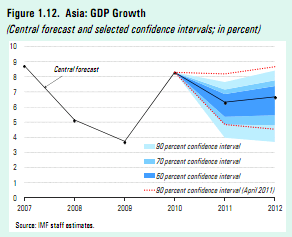

The IMF’s update on Asian growth includes some cautious commentary and a healthy downgrade of Asian growth. They now see 6.3% growth compared to a previous estimate of 7%. They say the risks are “decidedly tilted to the downside” as the macroeconomic weakness in the USA and Europe spill over into Asia:

“Growth in Asia has moderated since the second quarter of 2011, mainly reflecting a weakening of external demand. Domestic demand is still resilient, and it should continue to sustain activity across the region, contributing to relatively robust growth of 6.3 percent in 2011 and 6.7 percent in 2012 on average, slightly below our forecast last April. In Japan, the tragic earthquake and tsunami earlier this year had grave social and humanitarian costs and also set back the recovery; however, domestic demand is picking up as reconstruction efforts get under way and growth is expected to reach 2.3 percent next year. Meanwhile, inflation pressures have been elevated in a number of other Asian economies amid accommodative financial conditions, but should recede as food and energy prices gradually moderate.

Nevertheless, the report cautions that risks for the Asia and Pacific region are decidedly tilted to the downside. An escalation of the euro area financial turbulence and a more severe slowdown than anticipated in the United States would have clear macroeconomic and financial spillovers to Asia. While domestic demand remains strong, “Asia has clearly not “decoupled” from advanced economies,” the IMF says.”

You can read the full report here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.