I like to keep an eye on independent inflation gauges since I know there’s a great deal of skepticism regarding the government data. I even created my own index that I track since I don’t think the government’s tracking of inflation is quite accurate (though I know the inclusion of housing (investment) is not technically accurate from an economist’s perspective).

So what are the independent gauges telling us? They’re saying the same thing the BLS data is – inflation is still very low by historical standards. I’ve attached the latest readings from several independent gauges:

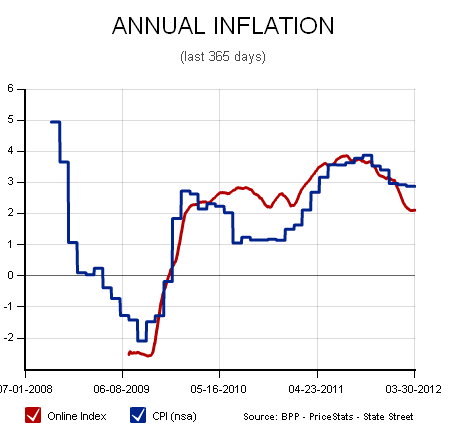

The Billion Prices Project shows inflation just above 2%:

The ECRI’s Future Inflation Gauge is actually DOWN 1.6% versus last year:

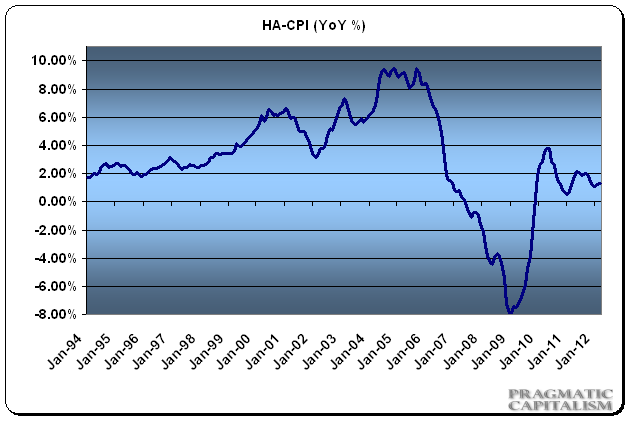

My Housing Adjusted CPI shows inflation at 1.3%:

And even Shadows Stats is showing a decline in the rate of inflation although they’re showing much higher levels than any of the other metrics:

None of this is terribly surprising given the stagnant economy. I’ve been fending off hyperinflationistas and even high inflationistas for years trying to explain that QE doesn’t cause inflation and that the government spending is just barely enough to offset the continued weakness due to the debt bubble. This morning’s BLS report confirmed that the economy remains in a muddle through environment and with this sort of slack in the economy and general lack of demand we should see continued low rates of inflation. The risk to this outlook is a big change in government spending, substantial rate of change in private investment and consumption (likely debt fueled) or a supply shock most likely in the form of Middle East tensions. I’d say the baseline scenario in the coming years is for continued low inflation….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.