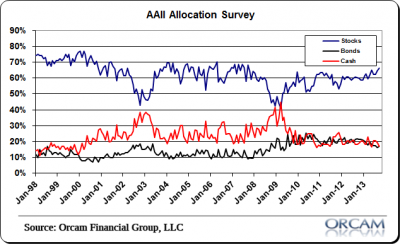

Equity allocations reached a 6 year high according to the latest AAII asset allocation survey. The latest equity allocation reading of 66.3% is a level that hasn’t been seen since 2007. The small investor has arrived to the part right on time!

Here are some more details from the AAII:

quity allocations reached a six-year high last month, according to the latest AAII Asset Allocation Survey. The increase occurred as cash allocations fell to their lowest level in five months.

Stock and stock fund allocations rose 1.8 percentage points to 66.3%. This is the largest allocation to equities since September 2007, when stock and stock fund allocations totaled 68.1%. October was the seventh consecutive month and the ninth out of the past 10 months with equity allocations above their historical average of 60%.

Bond and bond fund allocations rebounded by 0.9 percentage points to 16.9%. This is the second smallest allocation to fixed income since May 2009, trailing only last month’s figures. The rise brought bond and bond fund allocations back above their historical average of 16% for the 51st time in the past 52 months.

Cash allocation fell 2.7 percentage points to 16.9%. This is the smallest allocation to cash since May 2013 and the seventh month in the past 10 with an allocation reading below 20%. October was also the 23rd consecutive month with the cash allocation below its historical average of 24%.

The stock market’s rally is helping to boost the value of stocks and stock funds, as well as entice investors to either stick with equities or move money off of the sidelines into them. Optimism about the short-term direction of stock prices was higher than average throughout October, even though worries about the macro environment (slow economic growth, fiscal uncertainty, elevated stock valuations, etc.) continue to exist.

This month’s special question asked AAII members if they are overweighting or underweighting stocks relative to their age. Nearly 60% said they are overweighting stocks. The reasons given were mixed, though 15% of all respondents cited the current low interest rate environment and the possibility of poor bond returns in the future. Slightly more than 10% of respondents said they thought stocks simply provided more upside. Other respondents said they are overweighting stocks because they are not reliant on portfolio income, have pensions and other sources of retirement income, need portfolio growth because of their expected longevity or are trying to catch up on savings.

Approximately 13% of respondents thought their current allocations are appropriate, while slightly fewer than 15% said they are underweighted to stocks. Nearly half of those who are underweight stocks cited current equity valuations or Washington politics as the reason why.

Here is a sampling of the responses:

· “Overweighting stocks because bonds are such a bad investment right now.”

· “I’m overweighting stocks because of expected longevity.”

· “I’m my 80s and don’t rely on my savings for current expenses. It’s all going to my kids.”

· “At this point, we believe the current allocation to stocks (65%) suits our goals.”

· “I’m underweighting stocks because of current valuations.”

October AAII Asset Allocation Survey results:

· Stocks and Stock Funds: 66.3%, up 1.8 percentage points

· Bonds and Bond Funds: 16.9%, up 0.9 percentage points

· Cash: 16.9%, down 2.7 percentage points

October AAII Asset Allocation Survey details:

· Stock Funds: 35.6%, up 4.1 percentage points

· Stocks: 30.6%, down 2.3 percentage points

· Bond Funds: 13.5%, up 1.3 percentage points

· Bonds: 3.3%, down 0.4 percentage points

*The numbers are rounded and may not add up to 100%.

Historical Averages

· Stocks/Stock Funds: 60%

· Bonds/Bond Funds: 16%

· Cash: 24%

The AAII Asset Allocation Survey has been conducted monthly since November 1987 and asks AAII members what percentage of their portfolios are allocated to stocks, stock funds, bonds, bond funds and cash. The survey and its results are available online at https://www.aaii.com/

assetallocationsurvey.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.