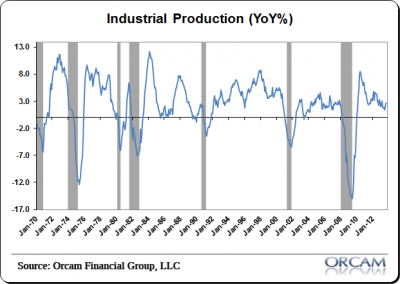

Industrial production is one of the better economic data points that we get on a monthly basis. And it’s been one of the few data points that tells a pretty convincingly positive story about the economy and has throughout the last few years. This month’s report was no exception. The latest industrial production reading of 99.36 is fast approaching the pre-recession high of 100.82. The latest year over year growth of 2.65% is up sharply from the last few readings in the 1.5% range and above the 40 year average of 2.25%.

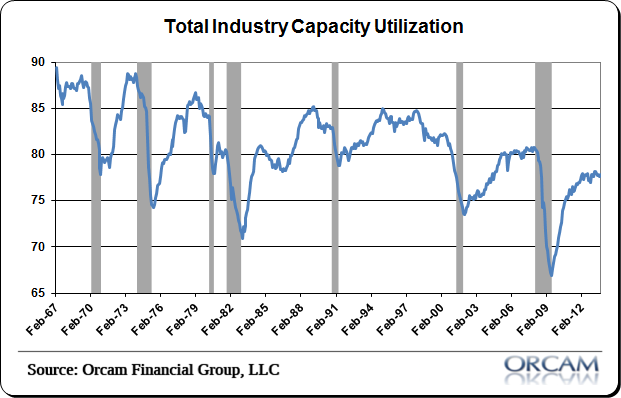

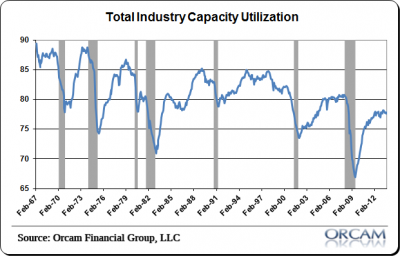

But while the economy is doing okay, it could be doing a lot better. Total capacity utilization continues to show just how sluggish the economy is. At 77.8 we’re still well off the historical average of 80.8. That’s not surprising given the amount of slack in the economy at present. The high unemployment rate is leaving a lot of potential output on the table.

In my view, this is all more of the same. The US economy is doing okay, but it’s not doing nearly as well as it should be doing. But most importantly, it’s not contracting. The muddle through continues….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.