This month’s CPI report showed a continuing higher trend in headline inflation. The headline came in at a 3.8% year over year rate while core CPI came in at 2.0%. For those keeping tabs, that 2% is the upper bound of the Fed’s core inflation target. I think this makes it increasingly uncomfortable for them to continue with their various “easing” programs.

It’s important to keep things in perspective here. 3.8% is only marginally above the historical average of 3.5%. But let’s not sugarcoat anything here – inflation is running hotter than most people are comfortable with. And with a weakening economy, this likely means that real GDP is going to have some additional downside pressures. The good news out of this report is that demand for goods and services is holding up reasonably well. The bad news is that cost push inflation via food and energy is becoming increasingly problematic and likely to continue diverting household spending from other items. In other words, cost push inflation appears to be overpowering demand pull inflation – a possibility the Fed did not input into their thinking when they implemented the egregiously ignorant QE2 program.

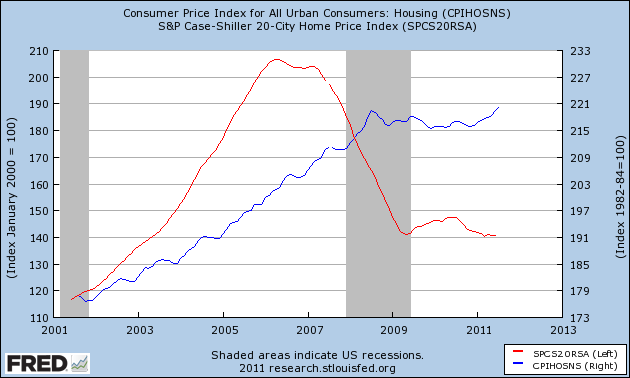

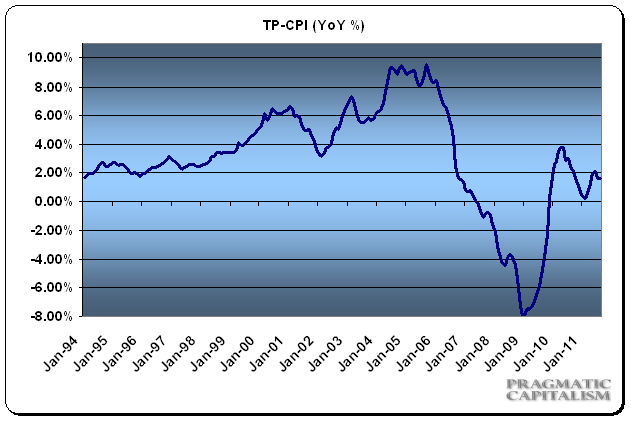

In addition, it’s important to note the rise in the housing component of this month’s report. At 42% of the CPI, this is by far the most important component. The CPI measures owners equivalent rent and not actual mortgage costs. The problem here is that OER is continuing to rise (an in fact never really reflected the housing collapse in recent years despite being the most important part of the entire inflation story). OER is up 2% year over year while home prices are down 5% year over year according to Case Shiller. See my TPCPI below for housing adjusted CPI figures. The following chart shows the extreme divergence in the data:

Earlier this year, I said I expected headline inflation to rise to levels around 2.5%. So, while I had the change in trend (from disinflation to inflation) right the trend has been more powerful than I believed. In the end, I think the stagflation story picks up a bit of momentum this month as the cost push inflation from energy is clearly becoming an increasingly destructive story for the American economy, but it is important to keep things in perspective here and not panic about CPI. Not only are we still near historical averages, but the data likely doesn’t reflect exactly what the US consumer is facing. That said, this still doesn’t represent a pretty picture for consumers and we should all hope the Fed wakes up to this fact before they implement further “easing” which is likely to only further damage the inflation story….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.