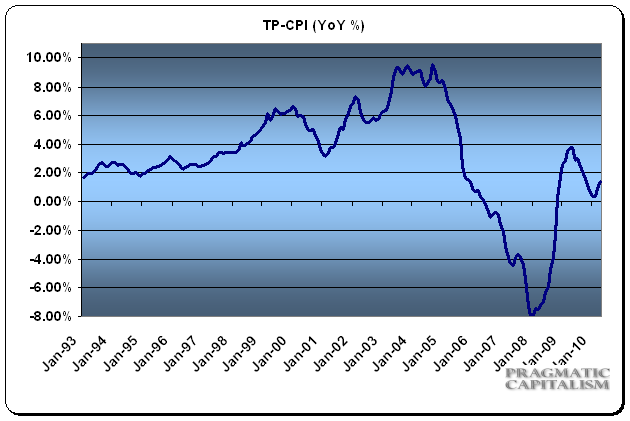

The government released their monthly report on inflation this morning and the trends of recent months continued to dominate the headlines. The rise in headline inflation is being driven mostly by the fuel component. Transportation continued to surge this month with a 2.8% rise. This isn’t surprising considering the rally in gasoline prices of late. Other price increases were benign across the board. As noted just recently, the CPI is dominated by motor fuel so it’s important to keep this all in perspective.

My inflation measure, which includes an adjusted housing component that more accurately reflects real trends in housing, remains in-line with the core CPI. This metric has proven more volatile over time, however, I believe it more accurately reflects the broad price impacts seen in the US economy. The fact that the current CPI downplays the US consumer’s largest asset is a rather notable error in my opinion.

All of this can help you see why the Fed would be hesitant to rely too much on energy component for policy purposes. Fuel prices are notoriously volatile (and seasonal) and spikes in energy have tended to be recessionary. For this reason, I think the Fed is responding to the rise in energy with accurate statements regarding the likelihood of “transitory” prices. More interesting, however, is the fact that they have likely influenced these “transitory” prices by exacerbating the speculation in energy markets via QE2. I think there’s a very good chance we wouldn’t be seeing this surge in energy (or a lesser surge) were it not for the Fed’s unleashing of QE2 on the markets….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.