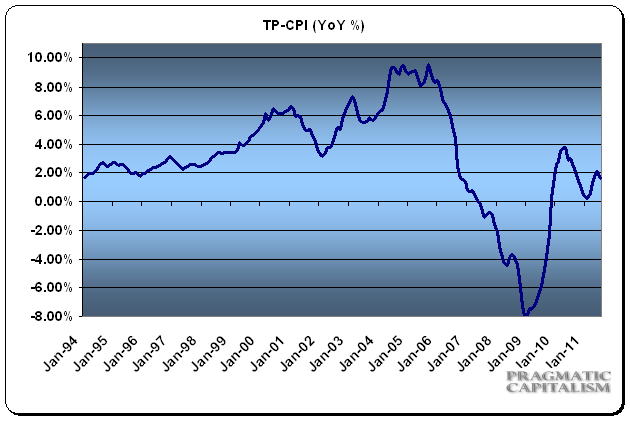

The July CPI report is likely to cause a bit of consternation for those worried about inflation. But let’s remember that the recent plunge in commodities did not begin until after the July reporting period. So it’s important to keep this data in perspective. For instance, the rise in gasoline in July accounted for almost HALF of the CPI’s gains this month. With a 10% decline in gasoline prices in August so far we can be almost certain to see disinflation in the upcoming data.

Overall, the report is going to spark stagflation fears. Not entirely unwarranted in my opinion. Headline inflation is uncomfortably high given the weak outlook for the economy. Headline inflation has certainly surpassed my expectations this year though not by much. Policymakers are likely to ignore the headline figure for reasons mentioned before. Core components remain very weak at just 1.8% YoY. Econoday provides some details on today’s report:

“Consumer price inflation surged in July on stronger gasoline and food costs. The consumer price index in July jumped 0.5 percent. The June number topped the median estimate for a 0.2 percent increase. Excluding food and energy, the CPI increased 0.2 percent after a 0.3 percent jump the prior month.

Turning to major components, energy rebounded 2.8 percent after dropping 4.4 percent the month before. Gasoline jumped 4.7 percent, following a 6.8 percent plunge in June. Food price inflation accelerated, jumping 0.4 percent, following a 0.2 percent rise in June. Within the core the shelter index accelerated in July (largely lodging, up 0.9 percent), and the apparel index again increased sharply ( up 1.2 percent). In contrast, the index for new vehicles was unchanged after a long string of increases.

Year-on-year, overall CPI inflation worsened to 3.6 percent from 3.4 percent (seasonally adjusted) in June. The core rate rose to 1.8 percent from 1.6 percent on a year-ago basis. On an unadjusted year-ago basis, the headline number was up 3.6 percent in July while the core was up 1.8 percent.

Despite a sluggish economy, inflation is back but most of the acceleration is supply related, notably for food. And energy rebounded only partially from the prior month. The lodging subcomponent, however, probably is seeing some improved demand which is actually a good thing. Inflation is up but not much is related to a surge in demand.”

This is also consistent with my inflation metric which includes a housing price component. Overall, the housing price decline has been the single most important factor in the recession’s overall impact and I feel as though the CPI does a poor job of reflecting this. The recent price declines in real estate, when measured more broadly then owners equivalent rent, show an overall inflation picture that is very much in-line with the core CPI.

On a slight side note – the increase in M2 in recent months is garnering quite a bit of attention. We saw this same thing occur during QE1 (where it also didn’t cause a surge in inflation). It’s almost entirely due to deposit increases that are offset by components that would be tracked in M3 were it still produced. M3 is running at a 2.5% rate according to Shadow Stats. Expect the M2 data to simmer down in the coming months.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.